Envision Planning

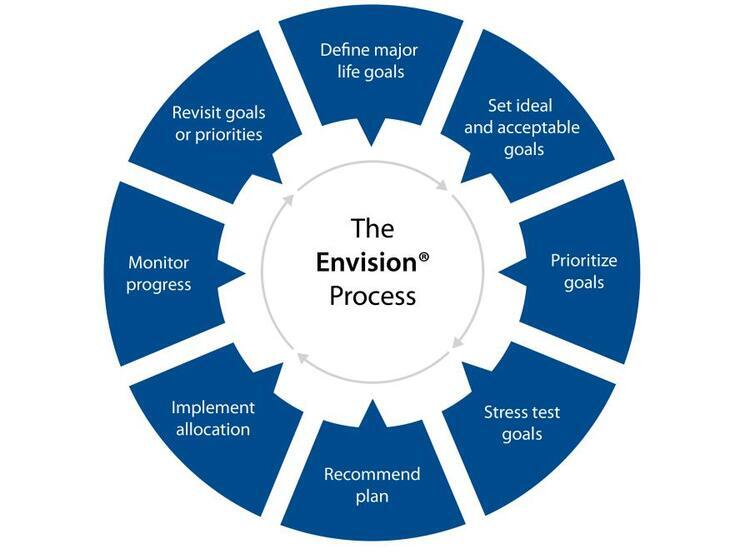

Using our Envision® planning process, your financial and personal circumstances are analyzed, and we are able to create a plan, as well as review cash flows, spending targets before and after retirement and view your personalized risk-based asset allocation. The Envision planning tool also allows us to run scenarios and adjust your strategies to help you sustain your lifestyle throughout retirement.

The most important part of the Envision process is the way you are able to monitor your progress toward the goals and dreams you wish to accomplish so you are always able to answer the question, "How am I doing?"

The most important part of the Envision process is the way you are able to monitor your progress toward the goals and dreams you wish to accomplish so you are always able to answer the question, "How am I doing?"

Step 1. Introductory Meeting

We will get to know each other and determine if there is a good fit. We learn about you and your personal situation and discuss your concerns and your goals for the future. We share information about our team and answer any of your questions.

Step 2: Understanding Your Financial Picture

We will begin gathering information and details of your current financial situation. We start with your life and plan your money around it. Our comprehensive evaluation includes understanding your:- Risk tolerance

- Dreams and priorities

- Retirement goals

- Estate investment planning needs

- Risk management and Insurance needs

Step 3: Recommending a Plan

Next, we present our recommendations. Combining Wells Fargo Advisors’ Envision planning technology with our planning expertise, we provide you with an assessment of your complete financial picture. We document your goals and you can monitor your progress toward reaching them.

Step 4: Monitoring Your Progress

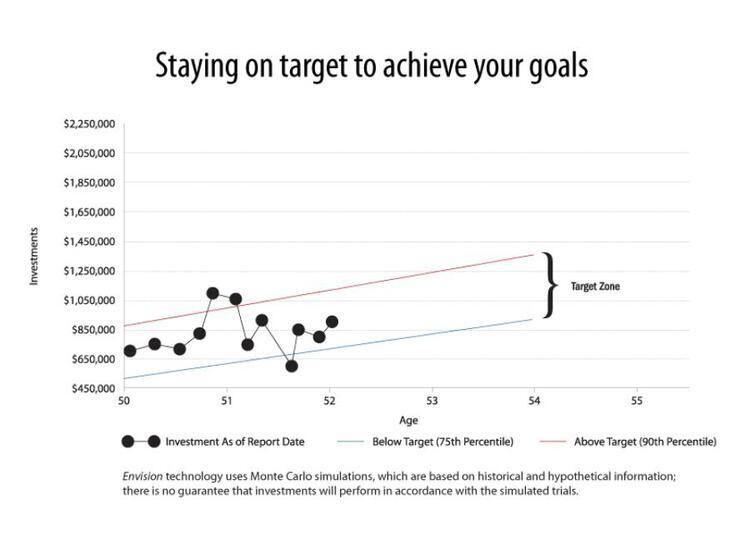

We chart your progress and meet with you to review and adjust your plan so it stays up to date and in sync with your changing life. By tracking your ongoing investment results against your Envision “Target Zone,” you’ll always be able to easily answer the question, “How am I doing?”IMPORTANT: The projections or other information generated by Envision regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Envision® methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2003-2021 Wealthcare Capital Management LLC. All Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.

Envision® methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2003-2021 Wealthcare Capital Management LLC. All Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.