Gregg Haglund

Vice President - Investments, PIM Portfolio Manager

I am a student of the markets, and as such, I freely admit that there are seemingly countless approaches that one can take to investing one's assets. I must say that there is endless and often mind numbing academia on investing, with each idea finding flaws in the previous or touting the Holy Grail. This industry wants so much (as does man I suppose) to put things neatly away in some quantifiable box. For as much as I haven't seen that come to fruition, I have found that if an investor can eliminate, or at least control the outside noise, and understands some behavioral risk that often erodes returns, uses a rules based approach and has guidance, that favorable outcomes prevail.

What's most important is what you learn after you think you know it all. After 25 plus years in this industry, I have distilled my thinking down to a practical approach that doesn't rely on forecasting the future with unknown information. For an overview of my approach to portfolio management, please see the follwing link: It Works Until It Doesn't →

Let me share with you a high-minded approach to the investing of your assets and of equal importance - how to sensibly convert those assets to take an income stream during retirement. Consider an exploratory meeting to learn more about how my capabilities might fit your needs.

2024 Outlook: A pivotal year for the economy and markets

Wells Fargo Investment Institute’s 2024 outlook for the economy, equities, fixed income, real assets, and alternative investments.

News and Insights

State of the Markets

A look at what’s happening now and what may be ahead from Darrell Cronk, President of Wells Fargo Investment Institute...

Read more

Portfolio Perspectives

Explore the intersection between timely topics and potential effects to your investments in Portfolio Perspectives reports...

Read more

Bringing Financial Relief to a Global Crisis

The fallout of the COVID-19 pandemic is being felt around the world. Wells Fargo is working hard to support its customers, employees, and communities...

Read more

Chart of the Week

Weekly chart using economic data to address timely market topics from the Wells Fargo Investment Institute Global Investment Strategy team...

Read more

Investment Strategy

Weekly market insights and possible impacts on investors from the Wells Fargo Investment Institute Global Investment Strategy team...

Read more

Looking Ahead

Looking for a fast way to stay up to date? How the markets performed over the last week and what may happen next week all...

Read more

Market Commentary

Weekly commentary providing analysis with an outlook for the equity market...

Read more

Bond Market Commentary

Updates on bond market data, news, and activity each day...

Read more

Stock Market News

Our market analysts keep you updated on the latest market trends including stock market data, news, market activity, and economic reports in the daily stock...

Read more

Your Investments: What Happens Next?

The anticipated reopenings of the U.S. and world economies may signal the next steps in recovery—which could provide opportunities for investors…

Read more

Global Perspectives

A weekly analysis of timely economic strategy issues from Wells Fargo Investment Institute...

Read more

Alternative Investment Strategies

Alternative investments can help diversify a traditional portfolio and provide the potential ofr improved risk-adjusted returns.

Read more

Asset Allocation

Lewis Carroll, the author of Alice’s Adventures in Wonderland, once said, “If you don’t know where you’re going, any road will get you there.” This

Read more

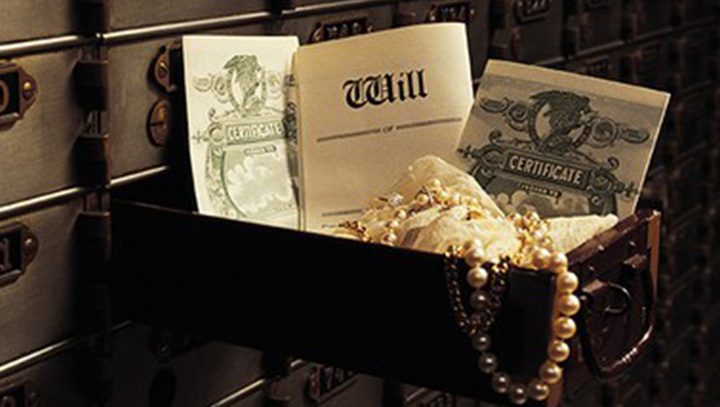

Estate Planning

By taking steps in advance, you have a greater say in how these questions are answered. And isn’t that how it should be? Wills and

Read more

Tax Deferral

“Tax deferral” is a method of postponing the payment of income tax on currently earned investment income until the investor withdraws funds from the account

Read more

Effects of Inflation

Are you saving for retirement? For your children’s education? For any other long-term goal? If so, you’ll want to know how inflation can impact your

Read moreImportant notice: You are leaving the Wells Fargo website

PLEASE NOTE: By clicking on this link, you will leave the Wells Fargo Advisors Web site and enter a privately owned web site created, operated and maintained by a third-party, which is not affiliated with Wells Fargo Advisors or its companies. The information and opinions found on this website have not been verified by our Firm, nor do we make any representations as to its accuracy and completeness. By linking to this Web site, Wells Fargo Advisors is not endorsing this third-party’s products and services, or its privacy and security policies, which may differ from Wells Fargo Advisors. We recommend that you review this third-party’s policies and terms and conditions to fully understand what information may be collected and maintained as a result of your visit to this website.