The Envision® Planning Process

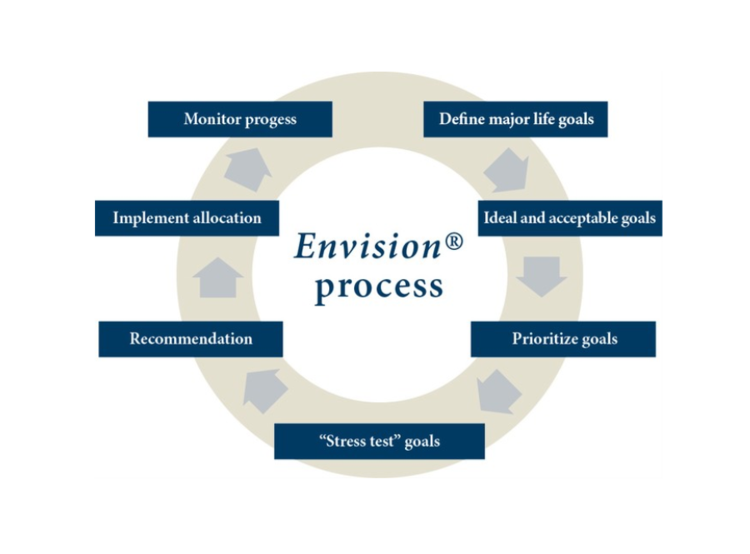

Our unique Envision planning process offers an easy, effective way to develop an investment plan designed to provide you with the wealth you need to live your life the way you want.

Building Your Plan

By blending the human dimension of personal conversations and goal-setting with high-tech statistical modeling, the Envision process goes way beyond investment processes that simply aim for a dollar amount or try to match a performance benchmark.

To begin the Envision process, we will sit down and discuss your lifestyle expectations, life goals, and financial objectives. Once you have decided on your ideal and acceptable investment approaches and outcomes, the Envision process will help you arrive at an asset allocation that supports your objectives.

To begin the Envision process, we will sit down and discuss your lifestyle expectations, life goals, and financial objectives. Once you have decided on your ideal and acceptable investment approaches and outcomes, the Envision process will help you arrive at an asset allocation that supports your objectives.

Aiming for your Target Zone

By tracking your ongoing investment results against your unique Target Zone rather than simply tracking your portfolio’s performance against a major standardized index such as the S&P 500, you are in a much better position to answer the question, “How am I doing?” This regular review helps ensure you are working toward your goals without making undue sacrifices or taking unnecessary risk.

As the graph below illustrates, a “reasonable” stress-test result – meaning that somewhere between 750 and 900 market simulations show you meeting or exceeding your goals – is your investment sweet spot. For that reason, we call this your “Target Zone."

As the graph below illustrates, a “reasonable” stress-test result – meaning that somewhere between 750 and 900 market simulations show you meeting or exceeding your goals – is your investment sweet spot. For that reason, we call this your “Target Zone."

Once a score is identified, how is it interpreted? Thanks to the balancing effect of the Target Zone, there is no need to aim for an Envision plan result of 100 – or even 90, for that matter. Anything above your target range, though indicating high confidence in reaching some of your high-priority goals, could also indicate you are assuming more risk than necessary or sacrificing some goals at the expense of others. Conversely, you do not want a score so low that you end up experiencing a lack of confidence in your ability to achieve your goals.

IMPORTANT: The projections or other information generated by the Envision tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

ENVISION METHODOLOGY: Based on accepted statistical methods, the Envision tool uses a simulation model to test your ideal, acceptable, and recommended investment plans. The simulation model uses assumptions about inflation, financial market returns, and the relationships among these variables. These assumptions were derived from analysis ofhistorical data. Using Monte Carlo simulation the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between

ENVISION METHODOLOGY: Based on accepted statistical methods, the Envision tool uses a simulation model to test your ideal, acceptable, and recommended investment plans. The simulation model uses assumptions about inflation, financial market returns, and the relationships among these variables. These assumptions were derived from analysis ofhistorical data. Using Monte Carlo simulation the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between