Huntington Kraus Financial Group

Huntington Kraus Financial Group

We believe no drug can be brought to market without its required trial phases.

We believe no trip should be taken without a map.

And we believe no family should begin their financial journey, especially across more than one generation, without some sort of comprehensive investment plan.

We believe no family plans to fail financially; it’s just that many families fail to plan.

Our goal is to help a family like yours make a comprehensive plan and then guide you through the completion of that plan, year after year, with your other advisors.

Our team has developed and refined a process to help successful life science executives put all of the pieces of their financial puzzle together.

It’s a dynamic process that seeks to adapt as your life unfolds and your needs evolve…helping to create clarity and confidence in your future.

2024 Outlook: A pivotal year for the economy and markets

Wells Fargo Investment Institute’s 2024 outlook for the economy, equities, fixed income, real assets, and alternative investments.

News and Insights

Wells Fargo About Money Podcast

Listen to Wells Fargo About Money featuring Michael Liersch. In season one, hear about the tough conversations that people may need to have about money.

Read more

State of the Markets

A look at what’s happening now and what may be ahead from Darrell Cronk, President of Wells Fargo Investment Institute...

Read more

Portfolio Perspectives

Explore the intersection between timely topics and potential effects to your investments in Portfolio Perspectives reports...

Read more

Bringing Financial Relief to a Global Crisis

The fallout of the COVID-19 pandemic is being felt around the world. Wells Fargo is working hard to support its customers, employees, and communities...

Read more

Chart of the Week

Weekly chart using economic data to address timely market topics from the Wells Fargo Investment Institute Global Investment Strategy team...

Read more

Investment Strategy

Weekly market insights and possible impacts on investors from the Wells Fargo Investment Institute Global Investment Strategy team...

Read more

Looking Ahead

Looking for a fast way to stay up to date? How the markets performed over the last week and what may happen next week all...

Read more

Market Commentary

Weekly commentary providing analysis with an outlook for the equity market...

Read more

Bond Market Commentary

Updates on bond market data, news, and activity each day...

Read more

Stock Market News

Our market analysts keep you updated on the latest market trends including stock market data, news, market activity, and economic reports in the daily stock...

Read more

Your Investments: What Happens Next?

The anticipated reopenings of the U.S. and world economies may signal the next steps in recovery—which could provide opportunities for investors…

Read more

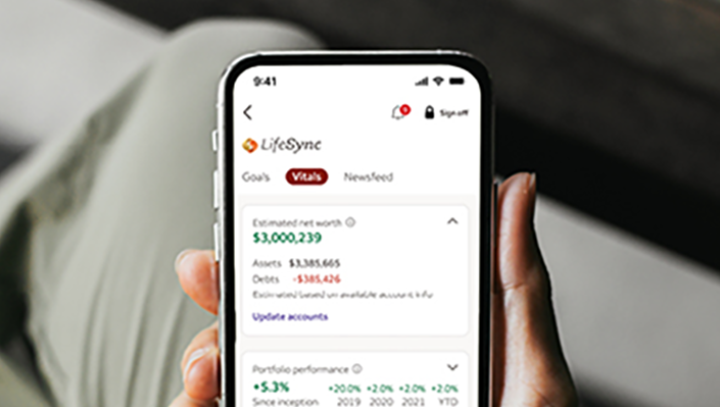

Be in the know on the go with LifeSync® in the Wells Fargo Mobile® app

Keep your goals in sight by keeping them on track. LifeSync connects you to the resources, tools, and people you need to help you make better financial decisions.

Read more

Global Perspectives

A weekly analysis of timely economic strategy issues from Wells Fargo Investment Institute...

Read more

Need to Finance a New Home?

Your Financial Advisor can bring strategic thinking to your home borrowing needs and refer you to a dedicated Wells Fargo Private Mortgage Banker

Read more

Alternative Investment Strategies

Alternative investments can help diversify a traditional portfolio and provide the potential ofr improved risk-adjusted returns.

Read more

What Is Whole Life Insurance?

Some of the pros and cons of whole life insurance

Read more

What Is Universal Life insurance?

Consider these tax-smart moves

Learn about tax-smart strategies to consider before year-end to make the most out of your money

Read more

College Financial Aid

Asset Allocation

Lewis Carroll, the author of Alice’s Adventures in Wonderland, once said, “If you don’t know where you’re going, any road will get you there.” This

Read more

Could My Family Benefit from a Family Limited Partnership?

Effective estate planning should address wealth transfer from a practical and cost-effective approach. One estate planning strategy that families with closely held businesses should consider is the family limited partnership.

Read more

Estate Planning

By taking steps in advance, you have a greater say in how these questions are answered. And isn’t that how it should be? Wills and

Read more

Maximizing Your Insurance Benefits

Understanding the threat of estate taxes on your life insurance proceeds is the first step in protecting these funds from unnecessary taxation. The next steps

Read more

Tax Deferral

“Tax deferral” is a method of postponing the payment of income tax on currently earned investment income until the investor withdraws funds from the account

Read more

What Gifting Strategies Are Available to Me?

There are a number of different gifting strategies available for planned giving. Each has its advantages and disadvantages.

Read more

Why Purchase Life Insurance

We’ve all heard about the importance of having life insurance, but is it really necessary? Usually, the answer is “yes,” but it depends on your

Read more

Effects of Inflation

Are you saving for retirement? For your children’s education? For any other long-term goal? If so, you’ll want to know how inflation can impact your

Read more

High Yield Meets Easy Access

Brokered Liquid Deposit is now available with a minimum opening deposit of $100,000. If you’re looking to make your excess cash work harder, this could be an option for you.

Read more

Bring Strategy to your Borrowing

You think of Wells Fargo Advisors for strategic investment planning. Find out how we can help make your borrowing more strategic, too.

Read more

Bring Strategy to the Way You Borrow

You follow a strategic investment plan to help you achieve your financial goals, but what about your borrowing needs? Wells Fargo Advisors can help you explore borrowing solutions too.

Read moreImportant notice: You are leaving the Wells Fargo website

PLEASE NOTE: By clicking on this link, you will leave the Wells Fargo Advisors Web site and enter a privately owned web site created, operated and maintained by a third-party, which is not affiliated with Wells Fargo Advisors or its companies. The information and opinions found on this website have not been verified by our Firm, nor do we make any representations as to its accuracy and completeness. By linking to this Web site, Wells Fargo Advisors is not endorsing this third-party’s products and services, or its privacy and security policies, which may differ from Wells Fargo Advisors. We recommend that you review this third-party’s policies and terms and conditions to fully understand what information may be collected and maintained as a result of your visit to this website.