Retirement Planning: How Secure Is Social Security?

You may have heard that a looming Social Security shortfall is threatening to affect future benefits. If you’re retired or close to retiring, then you probably have nothing to worry about — your Social Security benefits will likely be paid to you in the amount you’ve planned on. But what if your retirement is still many years away?

There are good reasons for concern, but Social Security is not likely to collapse entirely. Here is a closer look at how the program is structured and an update on its financial outlook.

How It Works

Social Security is a pay-as-you-go system, with today’s workers paying the benefits for today’s retirees. The first $132,900 (in 2019) of an individual’s annual wages is subject to the Social Security payroll tax, with half paid by the employee and half by the employer (self-employed individuals pay all of it). Payroll taxes collected are put into the Social Security trust funds and invested in securities guaranteed by the federal government. The Old-Age and Survivors Insurance (OASI) trust fund is then used to pay current benefits.

Demographic Pressures

Demographic changes are causing structural financial challenges for Social Security — namely, life expectancy is increasing and the birth rate is decreasing. Over time, fewer workers will have to support more retirees.

Social Security is already paying out more than it takes in. But by drawing on the OASI trust fund, Social Security should be able to pay 100% of scheduled benefits until fund reserves are depleted in 2035. Even then, payroll tax revenue alone should be sufficient to pay about 80% of scheduled benefits. This means if no changes are made by 2035, beneficiaries may receive a benefit that is less than they expected.1

Possible Fixes

The Social Security Administration continues to urge Congress to address the projected shortfall sooner rather than later. While no one can say for sure what will happen (and the political process is sure to be contentious), here are some solutions that have been proposed to help keep Social Security solvent for many years to come:2

- Raise the retirement age beyond age 67

- Raise the current payroll tax

- Raise the current ceiling on wages currently subject to the payroll tax

- Reduce future benefits

- Change the benefit formula that is used to calculate benefits

- Change how cost-of-living adjustments are calculated

- Allow individuals to invest some of their current Social Security taxes in “personal retirement accounts”

What’s at Stake?

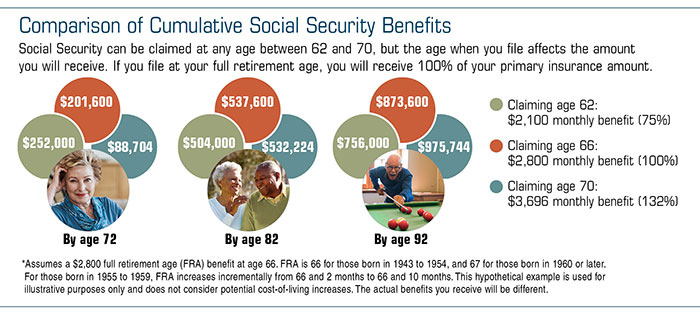

Although you probably won’t depend on Social Security to survive, the benefits you receive could amount to a meaningful percentage of your retirement income. Your retirement benefit is based on the average of your highest 35 years of earnings, so higher lifetime earnings result in higher benefits. For comparison purposes, the maximum monthly benefit payable to a high earner who retires in 2019 is $2,861, almost double the average retired worker’s benefit of $1,461.

No matter what the future holds for Social Security, your financial future is still in your hands. Focus on saving as much for retirement as possible, and consider various income scenarios when planning for retirement.

It’s also important to understand what you can expect to receive from Social Security under current law. You can find this information on your Social Security Statement, which can be accessed online when you sign up for a my Social Security account on ssa.gov. If you’re not registered for an online account and are not yet receiving benefits, you should receive a statement in the mail every year starting at age 60.