Can Your Personality Influence Your Portfolio? New Research Points to Yes

Academic researchers have been exploring how investors’ personalities might affect their financial decisions and wealth outcomes.

In one study, three finance professors (Dr. Zhengyang Jiang from Northwestern University’s Kellogg School of Management, Cameron Peng from the London School of Economics, and Hongjun Yan from DePaul University’s Driehaus College of Business) surveyed more than 3,000 members of the American Association of Individual Investors — a relatively sophisticated group of market participants. These researchers examined correlations between five personality traits and the investors’ market expectations and portfolio allocations.1

Another study (by Mark Fenton-O’Creevy from The Open University Business School and Adrian Furnham from the BI Norwegian School of Management) involved more than 3,000 U.K. participants. These authors looked for correlations between the same five personality traits and three measures of wealth: property, savings and investments, and physical items.2

Here’s a look at how these studies were conducted and some of their key findings, which may offer insight into how you can make more fruitful financial decisions.

The Big Five

Both studies were designed around the “Big Five” model of personality, which has long been used by psychologists to measure people’s personalities and identify their dominant tendencies, based on five broad traits. These traits are openness to experience (curious and creative), conscientiousness (organized and responsible), extraversion (sociable and action-oriented), agreeableness (cooperative and empathetic), and neuroticism (emotionally unstable and worry-prone).

Each participant was rated on a spectrum for each trait according to how they answered survey questions, the results of which typically capture how individuals differ from one another in terms of their feelings, preferences, and behaviors.

Meaningful results

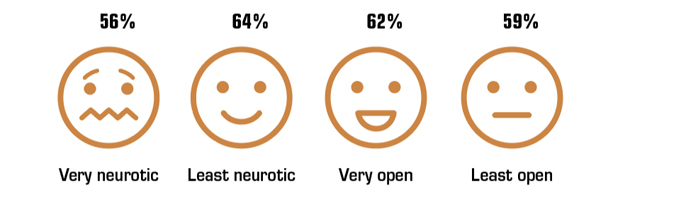

The first study pinpointed two traits that were closely correlated with investors’ market perceptions and investment behavior: openness and neuroticism. Investors who scored high for openness entertained the possibility of extreme market swings, but were more willing to bear the risk, and they allocated a larger share of their investment portfolios to stocks. Highly neurotic personalities were pessimistic about market performance, worried more about a potential crash, and had a smaller portion of their assets invested in stocks. The data also showed that investors who scored higher on neuroticism and extraversion were more likely to buy certain investments when they became popular with people around them — which could easily take them down the wrong road.3

The second study found that conscientiousness was positively correlated with all three measures of wealth, even more so than education level, often because this personality type brings a diligent approach to saving and investing. Unfortunately, the traits of agreeableness, extraversion, and neuroticism were associated with lower lifetime wealth accumulation. Highly agreeable people may devote more of their money to helping others and might also be more vulnerable to financial scams, whereas extroverts could be more impulsive spenders.4

Both studies found common ground in one respect: highly neurotic investors tend to be risk-averse, and their volatility fears may cause them to have overly conservative portfolios.

Share of portfolio invested in stocks, by personality type

Source: The Wall Street Journal, May 19, 2023

Implications for Investors

You might take some time to consider how your personality impacts the many financial decisions that you make in life. Becoming more self-aware may help you tap into your strengths and counter any weaknesses that could prevent you from reaching your goals.

Even the most experienced investors can fall into psychological traps, but having a long-term perspective and a thoughtfully crafted investing strategy may help you avoid costly, emotion-driven mistakes. Also, discussing your concerns with an objective financial professional might help you deal with tendencies that could potentially cloud your judgment.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful. Although there is no assurance that working with a financial professional will improve investment results, a financial professional can provide education, identify appropriate strategies, and help you consider options that could have a substantial effect on your long-term financial prospects.