We start with your life and plan your wealth around it

Getting To Know You

Everything begins with you. The goal is to engage and immerse you in the process. It starts with a conversation to learn about you, your family, your work life, and personal life. We focus on your short-term and long-term goals and priorities and build plans to help achieve them.We focus on understanding your:

-

Aspirations and priorities

-

Fears and concerns

-

Risk tolerance

-

Assets & liabilities

-

Sources of income and cash flows

-

Liquidity needs

-

Retirement goals

-

Estate investment planning needs

- Risk management and insurance needs including, life, long-term care, and disability

Trust services available through banking and trust affiliates in addition to non-affiliated companies of Wells Fargo Advisors. Wells Fargo Advisors and its affiliates do not provide legal or tax advice. Any estate plan should be reviewed by an attorney who specializes in estate planning and is licensed to practice law in your state.

Building Your Plan

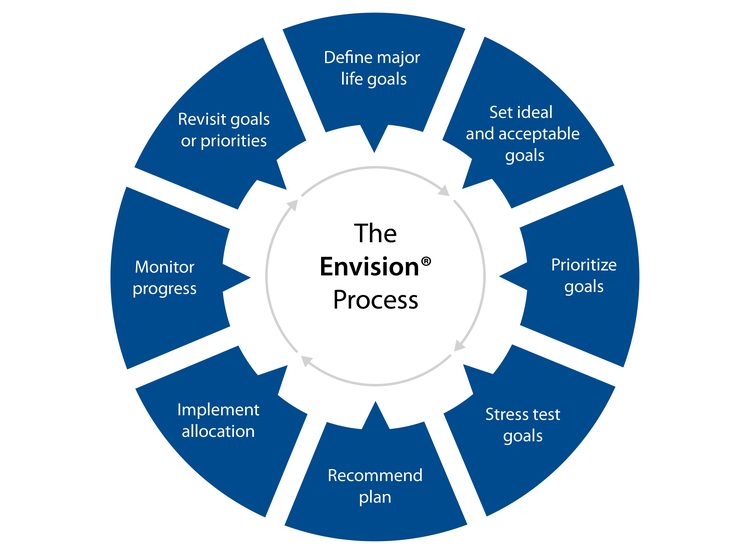

Next, we combine our planning expertise with Wells Fargo Advisors’ Envision® planning technology. Our goal is to provide you with an assessment of your complete financial picture. We use the Wells Fargo Advisors Envision planning tool to document your goals and review your progress toward reaching them. Transparency and mutual understanding is key to our success.

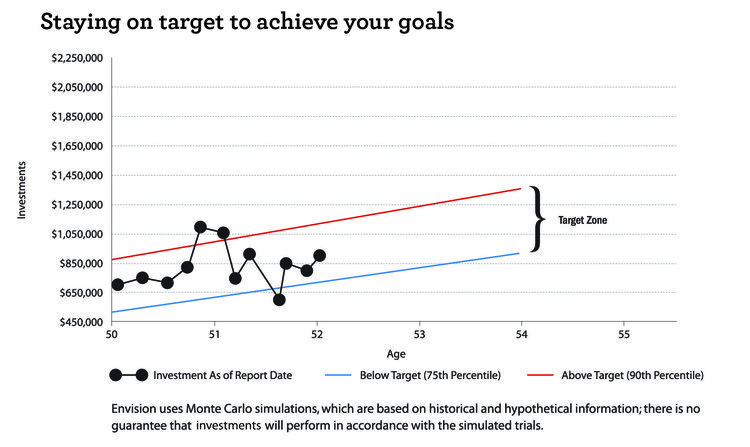

Track Your Progress

We review your progress and meet with you andadjust your plan according to changes in your life.By tracking your ongoing investment strategyagainst your Envision “Target Zone”, you’ll alwaysbe able to easily answer the question, “How am Idoing?”

IMPORTANT: The projections or other information generated by Envision regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time. Envision methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2003-2018 Wealthcare Capital Management LLC. All Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.