Matt Pirollo, CFP, RICP, ChFC

Financial Advisor, CERTIFIED FINANCIAL PLANNER®

An investment management process to weather all seasons

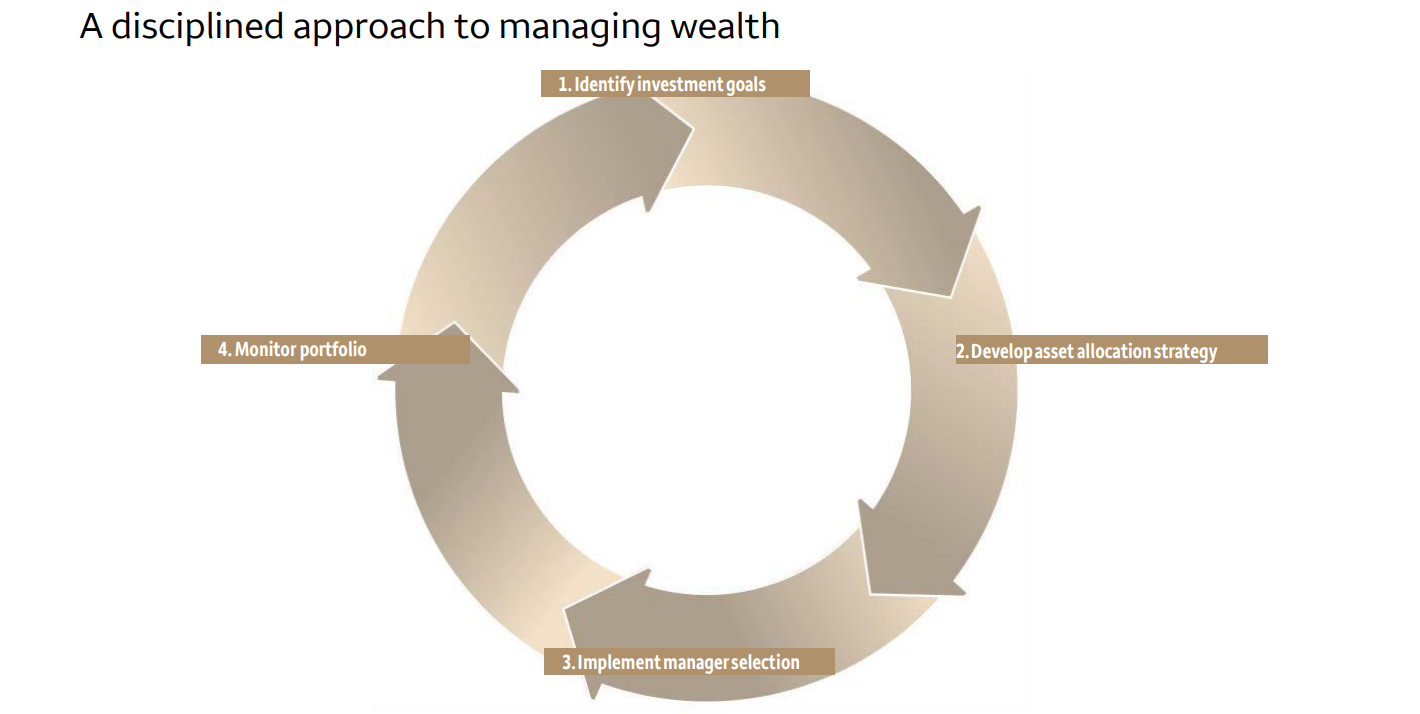

Managing wealth is a long-term commitment — one requiring a comprehensive strategy implemented through a series of sound investment decisions. We work together using a time-honored process to help select and implement personalized investment strategies, designed to help ensure you follow a prudent path for investing and achieving lifetime goals.

Successful investing requires a significant commitment of time, energy and attention. While most investors manage their investments part time, professional money managers focus their entire careers on managing assets. Their professional success depends entirely on their clients’ success.

Professional managers develop disciplines for buying and selling securities that eliminate decision-making based on unfounded principles. By electing to have experienced financial professionals manage your portfolio, you free yourself from the time-consuming task of choosing and actively managing your investments.

A managed investment process uses concepts similar to those followed by fiduciaries of retirement plans, foundations and charitable organizations. These methods help you follow your particular path for investing. What does it mean to be a fiduciary?

1. Identify investment goals and priorities. We thoroughly examine your investment needs, including financial requirements, time horizon, liquidity concerns and risk tolerance to provide a clear written description of your goals and guide investment recommendations.

2. Establish an asset allocation strategy.* Based on this analysis, we determine how your portfolio should be invested. Your asset allocation strategy will help guide the selection of investment managers.

3. Implement manager selection. After establishing a strategy, I identify a portfolio manager (or managers) whose style, philosophy and performance best suit your investment strategy. Your chosen manager is then responsible for selecting and monitoring the individual securities in your account.

4. Monitor portfolio. We will track the progress of your account toward your goals. Because market and economic conditions are ever-changing, I may suggest changes to your portfolio as necessary.

*Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns

As an important part of our commitment to you, we have developed a high standard of communication that will provide an easy understanding of your account. You receive monthly statements that detail each individual security and transaction within your account, as well as quarterly and annual performance reports. I can also provide market commentary to keep you abreast of underlying economic and market conditions.

Download the Wells Fargo Investment Institute’s report on the perils of trying to time volatile markets. And learn more abut the Wells Fargo Investment Institute - Who We Are

Together we will align your resources and objectives to help you thrive on your journey, today.

The next step

Schedule a conversation with Matt to help evaluate what planning opportunities may work best for you.

matthew.pirollo@wellsfargo.com