Embarking on a new client-advisor relationship can be an overwhelming experience. This is why we do things differently. Our 3 Meeting FIT Process is driven through the 3 D’s in our “3D FORMula” – Discovery, Design, and Deploy.

1st Meeting

Discovery – Is there a FIT?

During our initial meeting we will discuss your goals and objectives, and our approach to investment planning. Bear in mind, no decisions will be made during this meeting; rather, the purpose of this meeting is for each of us to determine if we have a basis for moving forward – is there a FIT? Our experience is that this approach is the foundation of a good long-term relationship.

2nd Meeting

Design – Fact Finding

Should a FIT be established, our second meeting entails learning more about your top priorities – your Family, Occupation, Recreation, and Money (FORM). We will delve into your family’s unique circumstances. We will examine your thoughts on retirement and your Family’s Investment Legacy. We want to know more about the bucket list items you want to check off your list. Finally, we will dive deep into your finances and cover numerous aspects to the overall planning process that we believe should be taken into consideration, such as: Wealth Management, Risk Management, Estate Management*, Tax Management*, and Debt Management. The information gleaned from this meeting will allow us to craft your Envision® plan.

3rd Meeting

Deploy – Implementation

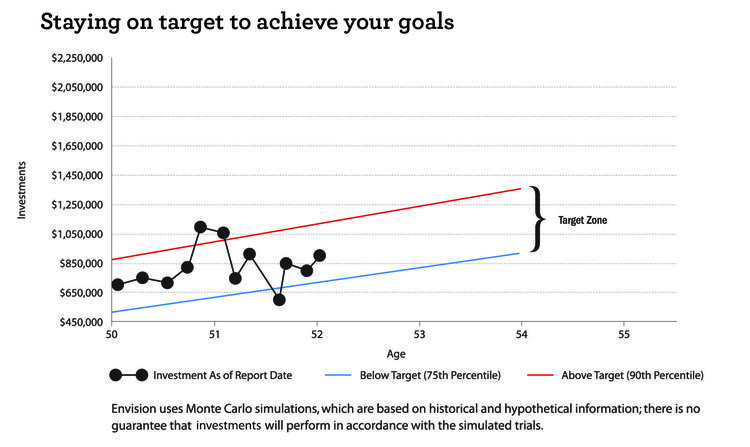

As a step in our process, we then analyze your needs and craft a detailed plan that stresses your top priorities. For this part of our process, we utilize Wells Fargo Advisors’ Envision plan. The Envision plan incorporates a goals-based planning philosophy to help you pursue your specific financial priorities and objectives. During our third meeting, we will review implementing the Envision plan, which is designed to help provide confidence that all the pieces of your financial puzzle are in place, clearly understood, and focused to address your needs. As we all know, when life changes, our needs change. We have refined our “3D FORMula” so that, as your life unfolds, your Envision plan can evolve with you.