The Sabatini Sweeney Financial Strategies Group

of Wells Fargo Advisors

Aspiring to Make a Profound Difference

PROFOUND: having intellectual depth and insight, extending far below the surface and, characterized by intensity of feeling or quality.

Our goal is to make a profound difference in the lives of our clients. We do so by utilizing a comprehensive team-based approach to wealth management. In other words, we serve the holistic needs of our clients and their families for all things financial.

We invite you to visit Meet Our Team to learn more about our team and how we collaborate with our clients.

2025 Outlook: Charting the economy's next chapter

Wells Fargo Investment Institute’s 2025 outlook for the economy, equities, fixed income, real assets, and alternative investments.

News and Insights

Need to Finance a New Home?

Your Financial Advisor can bring strategic thinking to your home borrowing needs and refer you to a dedicated Wells Fargo Private Mortgage Banker

Read more

High Yield Meets Easy Access

Brokered Liquid Deposit is now available with a minimum opening deposit of $100,000. If you’re looking to make your excess cash work harder, this could be an option for you.

Read more

Bring Strategy to the Way You Borrow

You follow a strategic investment plan to help you achieve your financial goals, but what about your borrowing needs? Wells Fargo Advisors can help you explore borrowing solutions too.

Read more

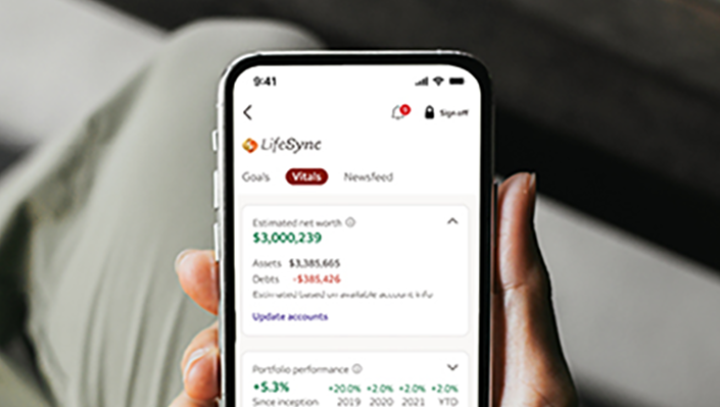

Be in the know on the go with LifeSync® in the Wells Fargo Mobile® app

Keep your goals in sight by keeping them on track. LifeSync connects you to the resources, tools, and people you need to help you make better financial decisions.

Read more

Estate Planning

By taking steps in advance, you have a greater say in how these questions are answered. And isn’t that how it should be? Wills and

Read more

State of the Markets

A look at what’s happening now and what may be ahead from Darrell Cronk, President of Wells Fargo Investment Institute...

Read more

Effects of Inflation

Are you saving for retirement? For your children’s education? For any other long-term goal? If so, you’ll want to know how inflation can impact your

Read more

Asset Allocation

Lewis Carroll, the author of Alice’s Adventures in Wonderland, once said, “If you don’t know where you’re going, any road will get you there.” This

Read more

Alternative Investment Strategies

Alternative investments can help diversify a traditional portfolio and provide the potential ofr improved risk-adjusted returns.

Read more

Tax Deferral

“Tax deferral” is a method of postponing the payment of income tax on currently earned investment income until the investor withdraws funds from the account

Read more

Portfolio Perspectives

Explore the intersection between timely topics and potential effects to your investments in Portfolio Perspectives reports...

Read more

Stock Market News

Our market analysts keep you updated on the latest market trends including stock market data, news, market activity, and economic reports in the daily stock...

Read more

Market Commentary

Weekly commentary providing analysis with an outlook for the equity market...

Read more

Looking Ahead

Looking for a fast way to stay up to date? How the markets performed over the last week and what may happen next week all...

Read more

College Financial Aid

Maximizing Your Insurance Benefits

Understanding the threat of estate taxes on your life insurance proceeds is the first step in protecting these funds from unnecessary taxation. The next steps

Read more

Why Purchase Life Insurance

We’ve all heard about the importance of having life insurance, but is it really necessary? Usually, the answer is “yes,” but it depends on your

Read more

Wells Fargo About Money Podcast

Listen to Wells Fargo About Money featuring Michael Liersch. In season one, hear about the tough conversations that people may need to have about money.

Read more

What Gifting Strategies Are Available to Me?

There are a number of different gifting strategies available for planned giving. Each has its advantages and disadvantages.

Read moreImportant notice: You are leaving the Wells Fargo website

PLEASE NOTE: By clicking on this link, you will leave the Wells Fargo Advisors Web site and enter a privately owned web site created, operated and maintained by a third-party, which is not affiliated with Wells Fargo Advisors or its companies. The information and opinions found on this website have not been verified by our Firm, nor do we make any representations as to its accuracy and completeness. By linking to this Web site, Wells Fargo Advisors is not endorsing this third-party’s products and services, or its privacy and security policies, which may differ from Wells Fargo Advisors. We recommend that you review this third-party’s policies and terms and conditions to fully understand what information may be collected and maintained as a result of your visit to this website.