Our Process For Managing Your Wealth

At Colatruglio Wealth Management Group of Wells Fargo Advisors, managing your wealth starts with a plan. Using our Envision® planning software we can create a customized plan for you that addresses important topics such as retirement planning, education funding, and multi-generational wealth transfer. We will assist you in achieving your goals and help you to address the challenges along the way.

Our investment methodology is driven by the belief that effective risk management will enhance after-tax return over time and that superior risk-adjusted return is the most important way to measure successful portfolio management. We use a combination of fundamental and technical analysis to over- and under-weight various market components while reducing or eliminating individual issue risk in our model portfolios.

*Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns.

1) Getting to know you

Everything begins with you. The goal is to engage and immerse you in the process. It starts with a conversation to learn about you, your family, your work life, and personal life. We focus on your short-term and long-term goals and priorities and build plans to help you achieve them.

We focus on understanding your:

- Aspirations and priorities

- Risk tolerance

- Assets & liabilities

- Sources of income and cash flows

- Liquidity needs

- Retirement goals

- Estate investment planning needs

- Risk management and insurance needs

2) Building your plan

3) Track your progress

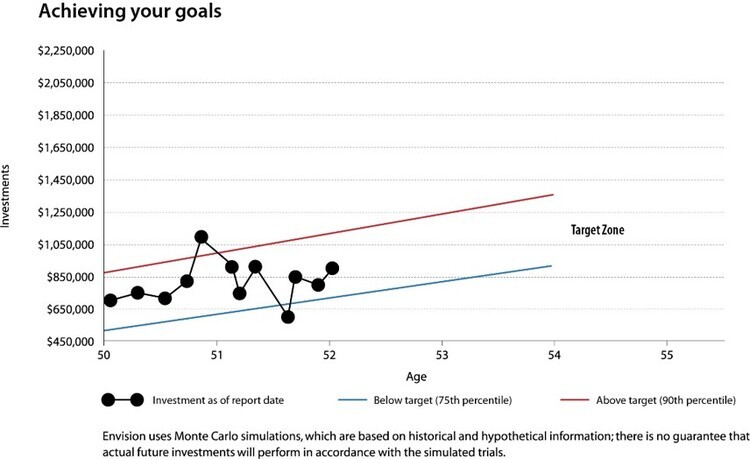

We monitor your progress and meet with you to review and adjust your plan according to changes in your life. By tracking your ongoing investment strategy against your Envision “Target Zone”, you’ll always be able to easily answer the question, “How am I doing?”

Connect with us to discuss your wealth planning needs - Click Here

Envision® methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2003-2021 Wealthcare Capital Management LLC. All Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.