Our Extensive Products and Services

The Envision® Process

Our wealth management process hinges on successful collaboration between our team and our clients. Our process is designed to establish and deepen relationships while implementing strong financial plans based on decades of wealth management experience.

Wells Fargo Advisors’ Envision process is a tested method to identify, define, and achieve your goals. Combining goalsbased advice with sophisticated statistical modeling, this unique process creates an effective, easy-to-understand method for you to prioritize and achieve important life goals.

The most important part of the Envision process is the way you are able to monitor your progress toward the goals and dreams you wish to accomplish so you are always able to answer the questions, “How am I doing?” before we tackle any investment recommendations or planning.

Step 1. Introductory Meeting

We will begin to get to know each other and determine if there is a good fit. We learn about you and your personal situation and discuss your concerns and your goals for the future. We share information about our team and answer any of your questions.

Step 2. Understanding Your Financial Picture

We will begin gathering information and details of your current financial situation. We start with your life and plan your finances around it. Our comprehensive evaluation includes understanding your:

- Risk tolerance

- Dreams and priorities

- Retirement goals

- Estate investment planning needs

- Risk management and Insurance needs

Step 3. Recommending a Plan

Next, we present our recommendations. Combining Wells Fargo Advisors’ Envision planning technology with our planning expertise, we provide you with an assessment of your complete financial picture. We document your goals and monitor your progress toward reaching them.

Step 4. Monitoring Your Progress

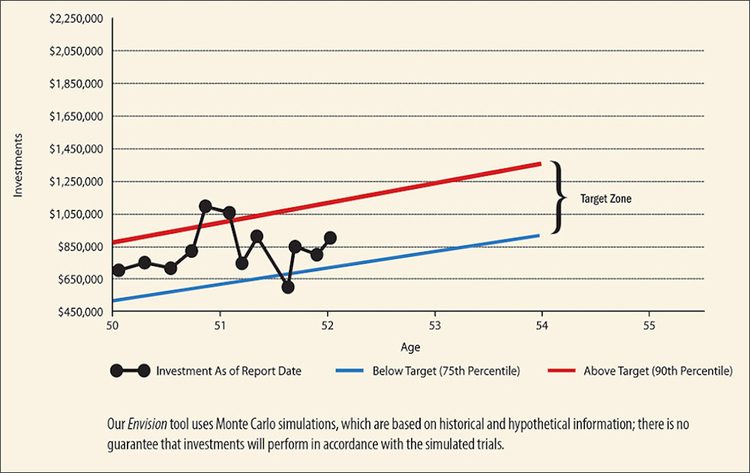

We chart your progress and meet with you to review and adjust your plan so it stays up to date and in sync with your changing life. By tracking your ongoing investment results against your Envision “Target Zone,” you’ll always be able to easily answer the question, “How am I doing?”

IMPORTANT: The projections or other information generated by Envision regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Envision® methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2003-2018 Wealthcare Capital Management LLC. All Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. Technical analysis is only one form of analysis. Investors should also consider the merits of Fundamental and Quantitative analysis when making investment decisions. Asset allocation and diversification are investment methods used to help manage risk. They do not guarantee investment returns or eliminate risk of loss including in a declining market.

Wealth Management

We take a personal approach to holistic wealth management, building plans and providing solutions tailored to an individual’s needs. The products and services we provide are simply a means to an end, and therefore we don’t take a “set it and forget it” approach. Investment planning is an ongoing process of preparing for and responding to critical financial events, which can be as diverse as retiring or receiving an inheritance. Our resources and experience help you to prepare for such events, so that you can achieve your financial and lifestyle goals.

Retirement Planning

IRAs and Distribution Options

Roth IRAs and Conversions

Business Retirement Plans

Investment Products

Stocks and Bonds

Mutual Funds

Exchange-Traded Funds

Certificates of Deposit

Annuities

Alternative Products

College 529 Savings Plans

Estate Planning Strategies

Charitable Giving Strategies

Access to Trust Services

Insurance Products

Life Insurance

Long-Term Care Insurance

Disability Insurance

Advisory services are not designed for excessively traded or inactive accounts, and may not be suitable for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for these programs is $10,000 to $250,000.

Wells Fargo Advisors and its affiliates do not provide legal or tax advice. Any estate plan should be reviewed by an attorney who specializes in estate planning and is licensed to practice law in your state.

Trust services available through banking and trust affiliates in addition to non-affiliated companies of Wells Fargo Advisors.

Insurance products are offered through nonbank insurance agency affiliates of Wells Fargo & Company and are underwritten by unaffiliated insurance companies.

Lending and other banking services available through Wells Fargo Advisors (NMLS UI 2234) are offered by banking and non-banking subsidiaries of Wells Fargo & Company, including, but not limited to Wells Fargo Bank, N.A. (NMLSR ID 399801), Member FDIC, and Wells Fargo Home Mortgage, a division of Wells Fargo Bank, N.A. Certain restrictions apply. Programs, rates, terms, and conditions are subject to change without advance notice. Products are not available in all states. Wells Fargo Advisors is licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act and the Arizona Department of Financial Institutions (NMLS ID 0906158). Wells Fargo Clearing Services, LLC, holds a residential mortgage broker license in Georgia and is licensed as a residential mortgage broker (license number MB2234) in Massachusetts.