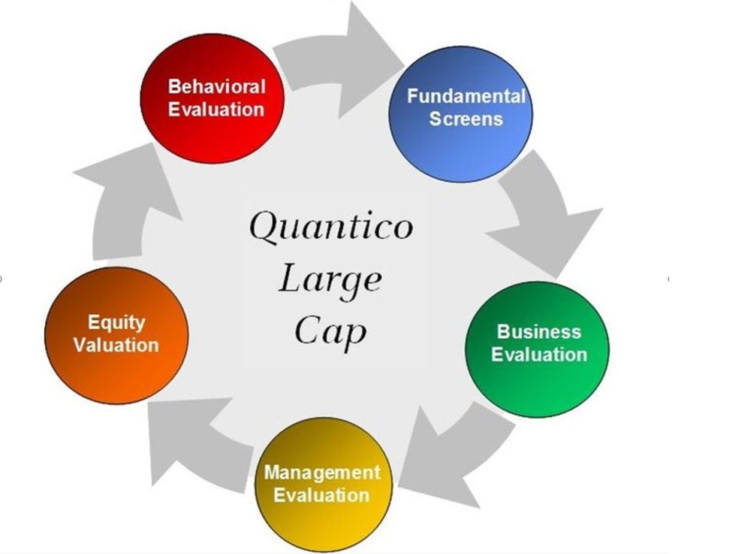

INVESTMENT PROCESS

Our multi-layered process focuses on bottom up analysis of target companies for potential investment. Our portfolio is designed to be benchmark sector aware and attempts to add value by finding the best in breed for each economic sector. First, we begin by filtering companies at high risk for severe loss of capital out of our initial investment universe. We then apply a custom analysis based on key financial metrics focusing on value and quality to screen and rank the remaining companies. For our selected targets, we generate an internal Discounted Cash Flow (DCF) valuation range that is the basis for further research as well as our buy and sell decisions. Our portfolio management process follows a core/satellite approach and is designed to invest with discipline.

SELL DISCIPLINE

Quantico Asset Management of Wells Fargo Advisors has a long-term investment perspective and historically low turnover. The primary drivers of our sell discipline stem from both relative valuation and opportunity costs. Further, we may also sell when various circumstances cause our investment thesis of a particular company to materially change, such as management weakness and/ or damage to the economic moat of a business. We will also sell and/or swap to preserve the relative alignment of sector weights to our benchmarks provided there is an appropriate opportunity to execute.

We also use custom analyses and tools to track portfolio positions for potential sell triggers. These strategies use a combination of portfolio weight, target price, recent sales and performance against the benchmark index to help us formulate a logical exit point.

DISCLOSURES

Portfolio Management is not designed for excessively traded or inactive accounts, and may not be suitable for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for this program is $50,000.There are no guarantees objectives will be met. Past performance cannot guarantee future results.

Asset allocation and diversification are investment methods used to help manage risk. They do not guarantee investment returns or eliminate risk of loss including in a declining market.