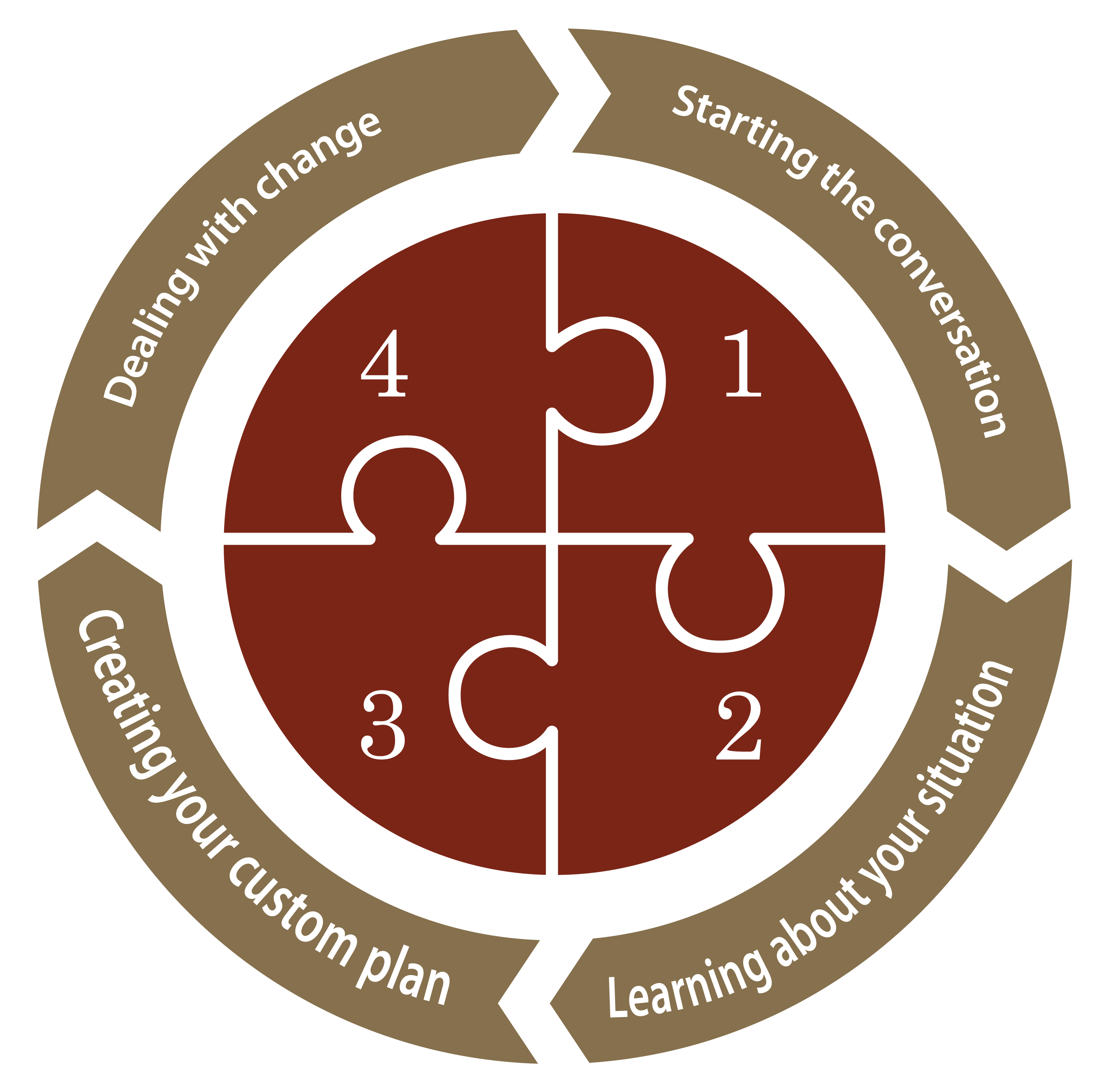

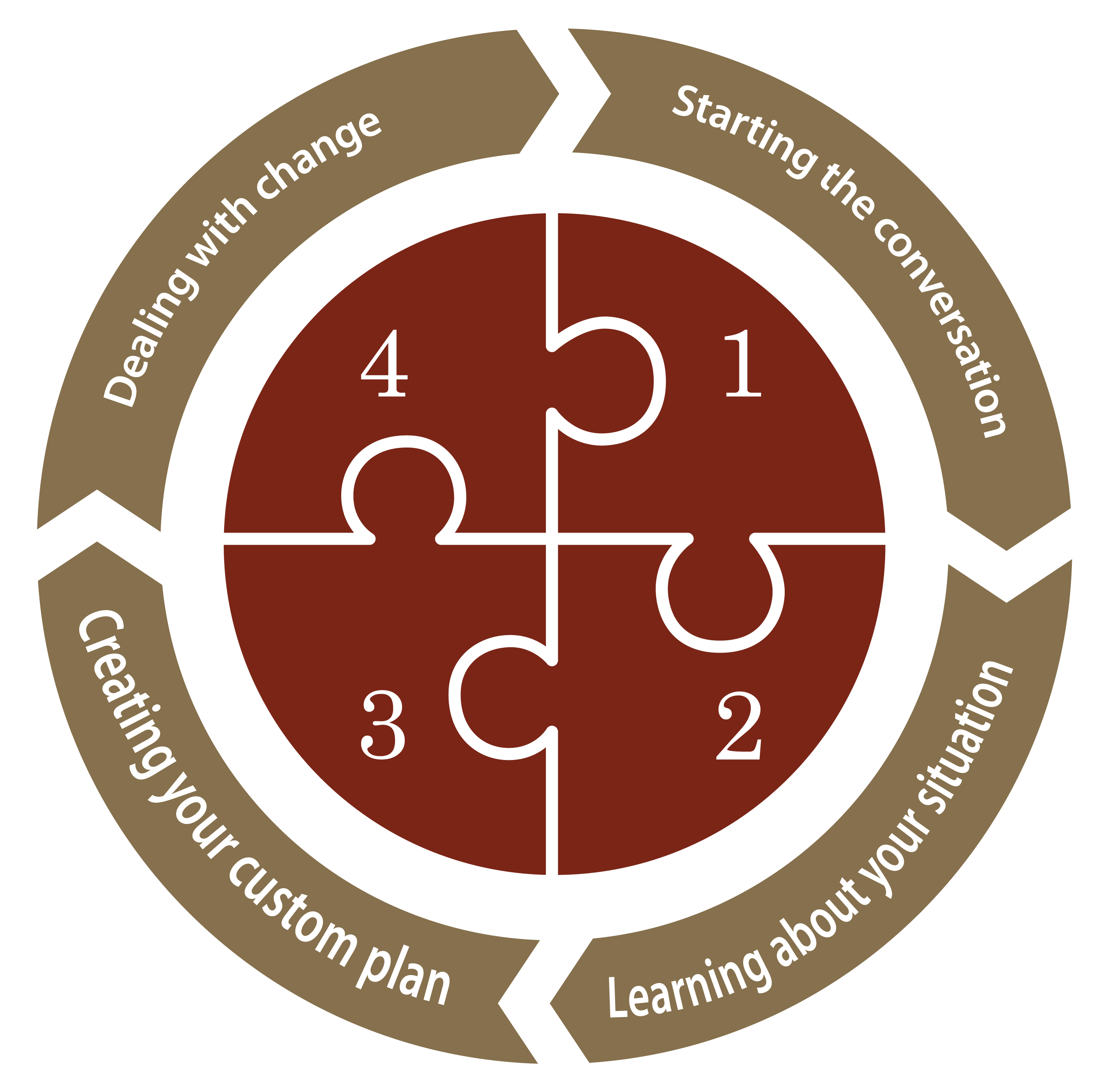

The planning process is designed to help bring clarity to your financial life. It helps you align your financial life with your real life. As we work with you we will explore your life goals, plan your investments around benchmarks that hold real meaning for you and help you track your progress toward them.

Step 1. Starting the conversation

During our initial conversation, we uncover the details of your financial life and discuss your long-term and short-term goals, priorities, and the investment strategies you already have in place. We share information about our team, investment approach, planning philosophy and our process.

Because your wealth management plan may cover many different areas and multiple generations of family members, we may also coordinate with your other professional advisors.

We review your plan and can evaluate investment results based on your goals so you’ll always be able to easily answer the question, ”How am I doing?”

Step 1. Starting the conversation

During our initial conversation, we uncover the details of your financial life and discuss your long-term and short-term goals, priorities, and the investment strategies you already have in place. We share information about our team, investment approach, planning philosophy and our process.Step 2. Learning about your situation

We gather information and details of your current financial situation. Our deep analytical approach and comprehensive evaluation includes understanding your risk tolerance, dreams and priorities, retirement goals, estate investment planning, and insurance needs.Step 3. Creating your customized plan

Next, we employ our sophisticated planning software to help create your strategic asset allocation and investment strategy. We'll also create coordinated wealth management strategies to consider your life and retirement goals, assets, liabilities, cash-flow requirements, levels of acceptable investment risk and asset allocation strategies.Because your wealth management plan may cover many different areas and multiple generations of family members, we may also coordinate with your other professional advisors.

Step 4. Dealing with change

Our personal approach, timely communication and high level of client service means we are here for you and can talk through any necessary adjustments to your strategy.We review your plan and can evaluate investment results based on your goals so you’ll always be able to easily answer the question, ”How am I doing?”