Associates

Barry Sullivan

- CIMA

- President

- Branch Manager

Barry Sullivan

- CIMA

- President

- Branch Manager

*Retirement Plans National Advisory Board

*Cash Management Account National Advisory Board

*Managed Solutions Group National Advisory Board.

In addition Barry taught two courses on Financial Planning for ten years at Merrill Lynch's National Training Center in Princeton, NJ. He holds the following security registrations: 7, 63, 65, & 24.

*Former Vice Chair of Bishop Kearney High School Board of Trustees

*Past President of Alfred State Alumni Council

*Past Chair St. Thomas the Apostle School Advisory Board

*Past President of St. Thomas the Apostle Parish Council

*National Representative for Wells Fargo Advisors Financial Network to the Services Institute (FSI) Financial Advisory Council

*Five terms, 2004, 2018, 2019, 2022, 2024 Wells Fargo Advisors Financial Network Licensee Advisory Board (LAB)

CA Insurance License Number: 0C89604. Resident State NY.

Contact

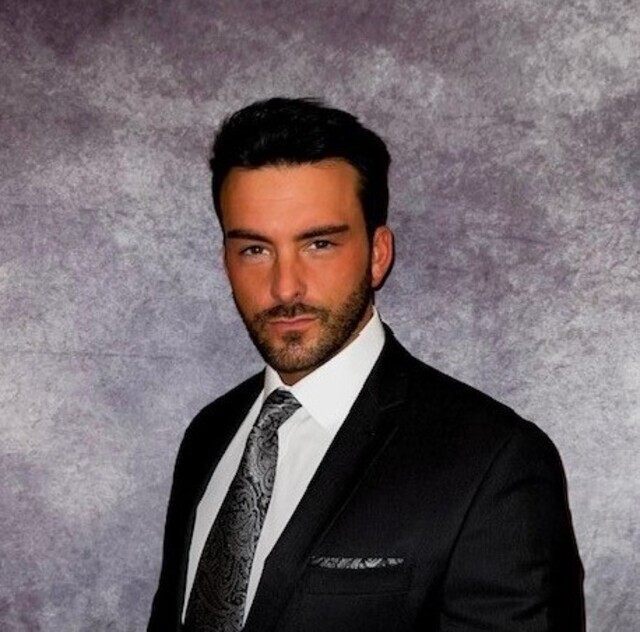

Jon Paul Penner

- First Vice President

Jon Paul Penner

- First Vice President

Prior to joining Sullivan & Associates Wealth Management, LLC, Jon Paul held the position of Financial Advisor at Merrill Lynch. He has his series 7 and 66 security registrations as well as New York State Life, Accident and Health Insurance licenses.

Jon Paul enjoys spending time with his wife and four children as well as being a volunteer fireman with the St. Paul Boulevard Fire Department in Irondequoit, NY.

Contact

Nilufer Getiren

- Senior Administrative Assistant

Nilufer Getiren

- Senior Administrative Assistant

Contact

Colleen S. Wangler

- Client Service Assistant

Colleen S. Wangler

- Client Service Assistant

Colleen, and her husband, Michael, (also a St. Bonaventure University graduate) have triplet daughters and the family enjoys Nordic skiing, hiking and any other outdoor activity.

Contact

Debbie Hilleman

- Senior Portfolio Administrator

Debbie Hilleman

- Senior Portfolio Administrator

Contact

Cheri Leight

- Branch Associate

Cheri Leight

- Branch Associate

Contact

Patrick Sullivan

- CFP

- Vice President

Patrick Sullivan

- CFP

- Vice President

Contact

Lynn Johnson

- Senior Vice President

Lynn Johnson

- Senior Vice President

Contact

Julie Roulo

- Administrative Assistant

Julie Roulo

- Administrative Assistant

In addition to duties as an Administrative Assistant, Julie was previously a Commodity Wire-Operator, Cashier, Compliance Associate, and Administrative Assistant to the Branch Manager.

Contact

Thomas G. Sanderson

- CRPC

- First Vice President

Thomas G. Sanderson

- CRPC

- First Vice President

Tom has 35 years in the wealth management profession that has included positions with Morgan Stanley Smith Barney, Merrill Lynch, Legg Mason and Wells Fargo Advisors Financial Network. These firms have given him specialized insights and experience with the complex matters of wealth management. He cut his teeth in the technology world at Hewlett Packard and Xerox Corporation. His education includes a bachelor’s degree in Biology from the College of Wooster in Wooster Ohio. In addition, he has done graduate work at the Rochester Institute of Technology (Photographic Science) and the State University of New York at Buffalo (MBA). Tom earned the Chartered Retirement Planning Counselor SM (CRPC®) certification by meeting rigorous professional standards and passing a comprehensive examination from the College for Financial Planning in Denver Colorado.

Tom holds securities registrations for General Securities (Series 7), FINRA General Securities Principal (Series 24), Uniform Investment Advisor Law (Series 65) and Uniform Securities Agent State Law (Series 63). He is also insurance licensed in Life, Accident and Health.

Active in the local community, he participates in many civic and community organizations, including the National Multiple Sclerosis Society. He and his wife Bonnie were born and raised in Western New York. They are the proud parents of three adult children and seven grandchildren.

Contact

Sean Keller

- Registered Operations Manager

Sean Keller

- Registered Operations Manager

Business Management. He began his professional career as a Real Estate Salesperson, Insurance

Salesperson, and an Insurance Claims Adjuster. Now a Registered Operations Manager with Sullivan & Associates Wealth Management LLC, he currently holds his series 7 and 66 security registrations as well as New York State Life, Accident and Health Insurance licenses.

Away from the office, he also enjoys golfing, the outdoors, watching the Buffalo Bills and Buffalo Sabres, and spending time with friends and family.

Contact

Michelle Lavigne

- CFP

- First Vice President

Michelle Lavigne

- CFP

- First Vice President

With over three decades of experience in the financial services industry, Michelle brings an uncommon depth of market knowledge and perspective to her clients. Her holistic and consultative approach focuses on building long term relationships with an emphasis on trust and satisfaction.

Michelle provides services to high net worth families and successful individuals including entrepreneurs, small business owners, corporate executives, professionals, and retirees.

At Wells Fargo Advisors Financial Network, Michelle has the PIM (Private Investment Management) Portfolio Manager designation.

She is also licensed through the State of CT with the Connecticut Partnership for Long Term Care.

Michelle received her CERTIFIED FINANCIAL PLANNER™ certification through the College for Financial Planning in Denver, CO in 1987 and served as President of the CT Financial Planners Association from 1999 – 2001.

She joined Merrill Lynch in 1991 and became an Assistant Vice President – Investments. In 1999 she joined Paine Webber which was later acquired by UBS Financial Services, Inc

In 2012, Michelle became a partner with Adaptive Wealth Management, LLC - an independent wealth advisory firm.

In August of 2017, Michelle joined Sullivan and Associates Wealth Management, LLC as First Vice President.

Throughout her career, Michelle has been involved in Community activities including serving in the past as a board member for the Saint Raphael Hospital Foundation and the Albert Schweitzer Institute for the Humanities.

Michelle is a graduate of Dartmouth College, (the 3rd class of co-education), an A.C.A. National Whitewater Canoe Champion and a past instructor of several Outward Bound Schools.

She lives in Charlotte, North Carolina with her husband Tim and enjoys skiing and swimming in her free time.

The PIM program is not designed for excessively traded or inactive accounts and is not appropriate for all investors. Please carefully review the Wells Fargo Advisors Financial Network advisory disclosure document for a full description of our services. The minimum account size for this program is $50,000.

Contact

Fred C. Goduti

- CFP

- Senior Financial Advisor

Fred C. Goduti

- CFP

- Senior Financial Advisor

Your personal priorities and values will drive the creation of a customized and dynamic plan where you and I will make changes based on your needs and choices as you face the everyday tradeoffs in life. Not only will this plan help to bring your life’s priorities and money together but it will become the basis of our relationship and allow you to focus and fund the things that matter most to you.

My role as a professional with more than 20 years of investment planning experience is to marshal the vast resources of Wells Fargo Advisors Financial Network on your behalf and to be your advisor, guide and advocate. That's the personal service I strive to deliver.

By way of background, I joined Wells Fargo Advisors in 1995 after receiving a Bachelor of Science degree in marketing from Franciscan University in Steubenville, Ohio. I also was awarded the Certified Financial Planner® certification from the College for Financial Planning in Denver, Colorado. CFP® certification includes a rigorous educational program and examination, as well as stringent experience requirements. As a CERTIFIED FINANCIAL PLANNE® professional I adhere to a professional Code of Ethics and fulfill strict annual continuing education requirements.

In addition to the CERTIFIED FINANCIAL PLANNER® certification, I am a Private Investment Management (PIM) Portfolio Manager - a designation awarded based on experience as a portfolio manager; a specified level of assets under management; industry experience; and successful completion of FINRA Series 65 or 66 exams. Only a small percentage of the Financial Advisors at Wells Fargo Advisors Financial Network meet these standards.

Away from the office, I am active in family and church activities and enjoy traveling, hiking, golf and tennis. I also serve as volunteer and former Commander of the local Fraternus Chapter mentoring program for young men about virtues. My wife Amy and I have eight children - Kathryn, Grace, Christian, Jake, Mary Rose, Clare and twins John and Brigid.

California Insurance License: 0H79020. Resident State: NC

The PIM program is not designed for excessively traded or inactive accounts and is not appropriate for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for this program is $50,000.

Contact

Douglas R. Jones

- CFA

- CFP

- Managing Director

- PIM Portfolio Manager

Douglas R. Jones

- CFA

- CFP

- Managing Director

- PIM Portfolio Manager

Post-MBA, Douglas worked in Corporate Debt Products at Bank of America providing public bank loans for Fortune 500 firms. He also has nearly three decades of private business ownership experience providing a unique understanding of his business clients’ needs. Doug’s industry experience includes: Healthcare, Private Equity, Financial Services, Retail Store/Sales, Apparel/Clothing, Foodservice/Hospitality, and Agro/Chemical. In addition, Douglas speaks Spanish and has worked in Europe and South America.

As a champion of improvement, Douglas has always strived to learn and expand for his clients. He earned the Chartered Financial Analyst® designation in 2016. The CFA® is a graduate level, multi-year program that develops and reinforces a fundamental knowledge of investment principles, such as ethical and professional standards, economics, quantitative methods, accounting, corporate finance, portfolio management, and wealth planning. In 2020, he earned the CFP® designation.

Doug graduated from Miami University with a BSB in Business-Marketing. He then went on to earn his Master of Business Administration (MBA) from the top-ranked Darla Moore School of Business at the University of South Carolina. He has studied International Business at ITESM in Guadalajara, Mexico and ESADE in Barcelona, Spain while completing an internship at Syngenta in Basel, Switzerland.

Douglas and his wife Sophie have 3 gregarious boys - Jack (12), Easton (9) and Grey (7). He is an avid traveler, visiting 30+ countries and enjoys coaching and watching his son’s play soccer, baseball and basketball. Douglas volunteers at several local churches and charities tutoring reading, math and finance.

CA Insurance License Number: 0G6964Z. Resident State (NC).

The PIM program is not designed for excessively traded or inactive accounts and is not appropriate for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for this program is $50,000.00.

Wells Fargo Private Bank (The Private Bank) experience connects clients with products and services provided by Wells Fargo Bank, N.A. and/or Wells Fargo Advisors. Wells Fargo Back, N.A. provides investment management services as part of its trust and fiduciary services, deposit products, lending products and other bank products. Wells Fargo Advisors provides investment advisory and brokerage services. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC. Member SIPC, a registered broker-dealer and non-bank affiliate of Wells Fargo & Company. Wells Fargo affiliates, including Financial Advisors of Wells Fargo Advisors, may be paid an ongoing or one time referral fee in relation to clients referred to the Bank. For Bank products and services, The Bank is responsible for the day-to-day management of the account and for providing investment services and wealth management services to clients. The role of the Financial Advisor with respect to Bank products and services is limited to referral and relationship management services. Eligibility for The Wells Fargo Private Bank experience is subject to change without prior notice. Products and services may have qualification or pre-acceptance requirements that are different that the eligibility requirements for The Wells Fargo Private Bank experience.

Contact

C. Edward Burke, Jr.

- CFP

- Managing Principal

- Senior Financial Advisor

C. Edward Burke, Jr.

- CFP

- Managing Principal

- Senior Financial Advisor

He has lived in the Hudson Valley for over 30 years and currently reside in Ulster County with his wife and three sons. Interests include triathlons, coaching, and soccer.

Ed’s education includes a Bachelor of Science-Finance, 1990, from S.U.N.Y. - New Paltz in New Paltz, NY. He is a member of the Business Advisory Council for the State University at New Paltz.

From May 2003 until May 2013, Ed was First Vice President/Branch Manager for Morgan Stanley/Smith Barney. Since May 2013, he has been a Senior Financial Advisor/Managing Principal at The Hudson Valley Financial Group of Sullivan and Associates Wealth Management, LLC.

Contact

Jeffrey A. Altomari

- Senior Financial Advisor

- PIM Portfolio Manager

Jeffrey A. Altomari

- Senior Financial Advisor

- PIM Portfolio Manager

His expertise, combined with the resources of the Wells Fargo Advisors Financial Network, allows him to deliver customized client solutions in order to help clients achieve their financial goals.

Jeff is a lifelong resident of the Hudson Valley, and currently reside in Dutchess County with his wife and 2 children. His interests include fly fishing, hiking, and exploring the outdoors.

Jeff is registered in the following states: AZ, CA, CT, DE, FL, GA, MA, MD, ME, NC, NJ, NY, NV, PA, SC, and VA.

Contact

Valerie Ellsworth

- Senior Registered Client Associate

Valerie Ellsworth

- Senior Registered Client Associate

She lives in Rosendale with her husband, Bruce and their two dogs Rocky and Rubi. She loves to travel, spend time with her granddaughter, Kya, as well as her family. She also fosters dogs, transports dogs and conducts home visits with Mountain Rottie Rescue and S.N.A.R.R Northeast. Her and her husband founded Nothing but Love Canine Foundation Inc. in 2020 after rescuing and rehabbing their dog, Rocky, a former bait dog. They have sponsored over 275 rescue dogs for spay/neuter services located in rural shelters since forming their foundation. Their program also sponsored 20 rescue dogs who need heart worm treatment since inception.

Contact

Corey Burke

- Client Service Associate

Corey Burke

- Client Service Associate

Contact

Stephan T. Raska

- CRC

- Senior Financial Advisor

Stephan T. Raska

- CRC

- Senior Financial Advisor

My mission is to provide every client with targeted, comprehensive financial advice and portfolio management-delivered with the highest level of personal service and professional integrity. This commitment to service also carries over to my involvement with our local community. Away from the office, I enjoy being outdoors and traveling with my wife and children.

It takes more than a single planning session to put your wealth to work in support of your life goals. It takes a process. As your life circumstances change, so must the investment strategies I use to help keep you on course toward your objectives. We’ll continue to work together through the years to keep your investment strategies aligned with your goals and needs.

Contact

Candy Alanis

- Operations Manager

Candy Alanis

- Operations Manager

Candy has worked closely with Stephan and enjoys managing the day-to-day operations of the office. She knows that serving clients with their individual needs is what sets her and the team apart from others.

In her spare time, she loves to cook with her husband, and they travel as much as possible.

Contact

Lauren Staudt

- Client Relationship Manager

Lauren Staudt

- Client Relationship Manager

Lauren’s prior experience has been beneficial in her successful transition to the world of personal finance. She is excited to serve clients as the Client Relationship Manager and feels strongly that working directly with clients is the cornerstone to a successful business.

Away from the office, she loves spending time with her husband, toddler son and 2 dogs. She also enjoys traveling, live music and is a self-proclaimed foodie!

Contact

Jerod Macko

- Managing Director

Jerod Macko

- Managing Director

Jerod started his career at Wells Fargo Advisors before pioneering Macko Financial to create better opportunities for the generations to come. His goal is to enable his clients to reach financial independence through a disciplined planning process. He earned a Bachelors of Business Administration with a concentration in Financial Analysis from the University of Buffalo.

A native of Marcellus, NY, Jerod and wife Bridget now raise their family there. On the weekends, you’ll either find him on the golf course or in the hunting blind!

Contact

Bridget Macko

- Operations Manager

Bridget Macko

- Operations Manager

A native of Central Square, NY, Bridget studied for her Bachelors in Business Administration from SUNY Oswego. She went on to earn her Masters in Sports Management from SUNY Cortland.

Bridget and her husband are currently raising their family in his native Marcellus, NY. Outside of the office, you’ll find her puttering around the garden, enjoying a good book, or spending time with her family.

Contact

Mark Murray

- Compliance Director

Mark Murray

- Compliance Director

Contact

William Thomas III

- Managing Partner

William Thomas III

- Managing Partner

Prior to creating Upper Valley Wealth Management, Bill was the Branch Manager, responsible for day-to-day operations of the branch and its advisors, of the Hanover, NH Wells Fargo Advisors location which he joined in 2003.

Before entering the wealth management business, Bill was an associate at North Castle Partners, a private equity investment firm in Greenwich, CT and worked in investment banking at Adams, Harkness & Hill in Boston, MA.

Bill has over 25 years of experience in the financial services industry and is a graduate of Dartmouth College. He presently serves as a trustee of the Montshire Museum of Science in Norwich, VT and serves on the Upper Valley Regional Advisory Board of the New Hampshire Charitable Foundation.

My Experience

⦁ 2021 – present : Upper Valley Wealth Management, Managing Partner

⦁ 2003 - 2021 : Wells Fargo Advisors, Senior Vice President – Branch Manager

⦁ 1999 - 2003 : North Castle Partners, Associate, Private Equity

⦁ 1996 - 1999 : Adams, Harkness - Investment Banking Associate

⦁ 1994 - 1996 : Putnam Investments, Marketing

My Areas of Focus

⦁ Advisory Services

⦁ IRAs & IRA Strategies

⦁ Retirement Planning

Education

Dartmouth College

Contact

Casey Dennis

- Senior Financial Advisor

- Partner

Casey Dennis

- Senior Financial Advisor

- Partner

He began his career at Dean Witter Reynolds where he served as Branch Manager of the Lebanon, NH office, continuing in the role when the company merged with Morgan Stanley in 1997. He is a graduate of Middlebury College.

My Areas of Focus

Portfolio Strategies

Retirement Planning

Contact

Dana Duellman

- Operations/Administrative Manager

Dana Duellman

- Operations/Administrative Manager

Prior to entering the wealth management business, Dana was the store manager at Starbucks in Hanover, NH. She also owned and operated a restaurant business in Lawrence, KS. After the sale of the business, Dana began a career in real estate until relocating to the East Coast.

Education

Arizona State University

Contact

Joe Marraccino

- Principal

- Senior Financial Advisor

Joe Marraccino

- Principal

- Senior Financial Advisor

Beginning in 2015, Joe brought his Wall Street skills to Main Street to help people confidently pursue and reach their life and financial goals. Whether planning for or living in retirement, changing jobs or careers, saving for a child’s or grandchild’s education or experiencing other life-changing events -- Joe loves to help.

Joe grew up in Queens, NY and learned the value of a dollar and hard work from his parents -- his Mom, a homemaker, and Dad, a small business owner. Joe graduated from Cornell University with a degree in Applied Economics, and, while working at the Federal Reserve Bank, earned his MBA in Finance from Fordham University.

Joe and his wife, Jen, live in Nyack, NY where they raised their two sons and two daughters and remain active community members. Joe is a Leadership Rockland graduate, former vestry member for his church, and a multi-youth-sports coach and previous, long-time little league baseball board member. In his free time, Joe likes to stay fit playing racquet sports, swimming and biking.

Contact

Al Kruger

- Senior Vice President

Al Kruger

- Senior Vice President

Al graduated from Davis & Elkins College with a major in business administration. He and his wife Ellen live in New York City, have two adult children and are proud grandparents.

Contact

Brewster Sears

- Executive Vice President

- PIM Portfolio Manager

Brewster Sears

- Executive Vice President

- PIM Portfolio Manager

Brewster started his initial training on the 62nd floor of the South Tower, World Trade Center with Dean Witter. Over the last three decades he has managed accounts for clients at PaineWebber, Janey Montgomery Scott, and RBC Wealth Management in Syracuse, NY where he was Branch Director. In December of 2016, Brewster returned to Janney to work in the Skaneateles office. In June of 2023, Brewster joined Sullivan & Associates Wealth Management, LLC and works out of Skaneateles, NY.

Contact

Regina Abbott

- Senior Operations Manager

Regina Abbott

- Senior Operations Manager

Contact

John M. Dusza

- CFP

- Registered Principal

John M. Dusza

- CFP

- Registered Principal

I believe successful investing requires both market insight and a long-term perspective. Recognizing that each client is unique, I create customized plans and portfolios to match each client’s financial goals and risk tolerance.

My goal is to deliver value-added, objective advice that will make a difference in the quality of each client’s financial life.

After graduating from Guilford High School, I attended Dartmouth College and graduated cum laude with a degree in Government.

My graduate education includes an MBA from the Yale University School of Management and a law degree cum laude from Quinnipiac University Law School, where I attended evening classes while working full time. I am admitted to the Connecticut Bar, but am not currently practicing.

I began my career as a financial advisor at Morgan Stanley Dean Witter and was an advisor at UBS Financial Services before joining Wells Fargo Advisors Financial Network in 2012. I earned the CERTIFIED FINANCIAL PLANNER® certification in September 2014 and hold the Series 7, 24, 63 registrations and insurance licenses.

My community activities include volunteering at St Margaret Church and serving on the Planning & Zoning Commission in Madison, CT.

Contact

Julie Culver

- Client Associate

Julie Culver

- Client Associate

During Julie’s time at SUNY Fredonia, she played lacrosse and enjoyed volunteering/interning at the local humane society.

Contact

David Gallentine

- CFP

- Senior Financial Advisor

David Gallentine

- CFP

- Senior Financial Advisor

David is a member of the Financial Planning Association® organization committed to advancing the planning profession. Another organization David is very involved with is Rotary International. David is also involved with Rotary and has served as local club president. In his spare time, David enjoys motorcycling and American history.

Contact

Frank Durand

- CFP

- Senior Financial Advisor

Frank Durand

- CFP

- Senior Financial Advisor

Frank enjoys the outdoors, particularly fishing, kayaking, biking and hiking. In 2013 he and a friend traveled to Spain to hike the El Camino de Santiago (The Way of Saint James). He is an avid reader and enjoys all kinds of books, particularly books on American History.

*Wells Fargo Advisors Financial Network is not a legal or tax advisor.

Contact

Debra McIntyre

- Client Service Associate

Debra McIntyre

- Client Service Associate

Throughout her career, Debra’s primary objective has always been to provide clients and their families with capable, personalized assistance and care.

Debra is a past president and long-time member of Rotary, dedicated to serving and improving her community. She finds enjoyment in the beaches and wildlife of southwest Florida and exploring the unique and vastly different regions of the sunshine state.

Contact

Robert Coombs

- CLU

- ChFC

- Senior Financial Advisor

Robert Coombs

- CLU

- ChFC

- Senior Financial Advisor

In 2004 he moved to HSBC as a senior financial advisor and Vice president. He grew his practice with the help of his partner Anthony Ortiz and Registered Account Administrator Derek Pinelli. Over the years his client base grew to over 1200 clients and over $170,000,000 in assets under management by January of 2015. Bob stayed with First Niagara investment services after their acquisition of HSBC, then started The Captiva Group in 2016.

Bob also is a Chartered Financial Consultant® and Chartered Life Underwriter® from the American College. Bob lives in Newburgh with his wife Lori.

Here Bob, Financial Advisors Taylor Coombs and Anthony, can apply their proven philosophies of nurturing their client's financial goals and objectives, as well as applying a personal touch to each and every one of our clients.

Contact

Anthony Ortiz

- Senior Financial Advisor

Anthony Ortiz

- Senior Financial Advisor

Anthony has almost 21 years’ experience in the wealth management field. His career started in 2003 with MetLife Financial Services which gave him a great foundation in Life insurance and Annuity products. In 2007 he joined HSBC Securities and First Niagara Bank where he worked closely for 9 years with Robert Coombs, Senior Financial Advisor, who took the time to mentor him and ultimately partner with him. It was here that Anthony gained the necessary knowledge of the investment management business as well as the ethical practices needed to thrive long term in this business. In 2016, Anthony, Robert Coombs, Registered Operations Manager Derek Pinelli and Financial Advisor Taylor Coombs joined forces with Wells Fargo Advisors Financial Network in order to start their company, The Captiva Group. Our Company Mission is simply to have great products available to help our clients reach their financial goals while also delivering a very personal and professional client experience.

Contact

Taylor Jenaro Coombs

- Senior Financial Advisor

Taylor Jenaro Coombs

- Senior Financial Advisor

It was always a dream of Taylor’s to work alongside his father Robert M. Coombs who has over forty-five years’ experience as a Financial Advisor. Taylor grew up in a home where both his Father and Mother were Financial Advisors. He had an interest in finance at a very young age.

In 2016 Taylor made the transition into the Investment Services side of the financial services business. Taylor then joined his Father and his business partner, Senior Financial Advisor Anthony Ortiz and Registered Operations Manager Derek Pinelli at the long established Captiva Group. Captiva Group is a privately owned business affiliated with Wells Fargo Advisors Financial Network, domiciled in Newburgh, NY. Four years later in 2020, Taylor took the next step in his career by becoming partner at The Captiva Group.

Taylor and the team share the sole ambition of wisely managing their client’s finances. The Captiva Group’s goal is to guide clients so they can achieve their financial dreams and goals. This is done by simultaneously helping them navigate the financial barriers that inevitably arise in every phase of life.

Taylor resides in the Town of Newburgh with his wife Sasha.

Contact

Derek Pinelli

- Registered Operations Manager

Derek Pinelli

- Registered Operations Manager

Their mission at The Captiva Group is simple, to have a great platform of products to offer their clientele while giving them a very personal and professional client experience.

Contact

David J. Maher

- Managing Principal

David J. Maher

- Managing Principal

14 years of competitive swimming

2 years driving a Zamboni

1 lifelong love of the ocean

Focus

David works with business owners, high net worth individuals and families in the areas of investment planning, risk management and asset preservation, estate planning strategies and wealth transfer, charitable giving, endowments, and planning for closely held business owners and executives. David takes a panoramic approach towards working with clients to help them build, manage, preserve and transfer their wealth.

Background And Experience

Originally from Spokane, Washington, David received his Bachelors of Science in Biology while attending the University of New Mexico where he swam competitively at the Division I level.

David is a managing principal and a CERTIFIED FINANCIAL PLANNER® professional with more than 15 years of experience in financial services. In 2021, he completed an executive education in Wealth Management Theory and Practice through the Yale School of Management and became a Certified Private Wealth Advisor™ certificant.

Additionally, he holds the Accredited Asset Management Specialist SM and Accredited Wealth Management AdvisorSM designations as well as holds the Series 24 General Securities Principal, Series 7 and Series 66 securities registrations and insurance licenses. David is a co-founder of Backshore Wealth Management Group and serves as the Managing Principal.

Away From The Office

David and his wife Reyna moved to Vermont in 1995, they reside in Essex Junction with their 3 miniature schnauzers. They have two adult children who are attending Bentley University and Providence College. When not serving clients, David enjoys running, hiking, swimming, reading, smoking meat and spending time near the ocean in Rockport, Massachusetts. David is passionate about hockey and supports the Essex Junction Youth Hockey Association and the Juvenile Diabetes Research Foundation.

Contact

Paul D. Briody

- President

Paul D. Briody

- President

10 years as a Ski Coach - Sugarbush

20 years of Kayaking

35 years visiting Cape Cod

Focus

Paul helps clients build comprehensive investment plans that address financial goals for their families and their future generations. As a Fundamental Choice Portfolio Manager he can work closely with you to determine where you are financially today, where you want to be tomorrow, and then defines and explains the necessary steps to pursue those goals.1

Background And Experience

Paul is President and a CERTIFIED FINANCIAL PLANNER® professional with more than 30 years of experience helping clients reach their goals.2 Paul was also named as one of Forbes’ 2021 Best-in-State Wealth Advisors in Vermont.3

Paul joined A.G. Edwards, a predecessor firm to Wells Fargo Advisors in 1990. Wells Fargo Advisors has named Paul a Platinum Council Advisor in 2016, 2017, 2018 and 2019. In 2019, Paul transitioned to Wells Fargo Advisors Financial Network (WFAFN) and in 2020 and 2021 he was again named a Platinum Council Advisor.4 Paul graduated from Providence College with a Bachelor of Science in Business Administration and has lived in South Burlington, Vermont with his wife Amy since 1990. They have two grown children that both attended CU-Boulder and currently work in Boston.

The Backshore Wealth Management Group is focused on working with high net worth individuals, foundations, and families in the areas of portfolio management, succession plans, charitable giving and estate planning strategies, wealth transfer, business retirement planning, income distribution planning and educational planning to include Section 529 Savings Plans. In addition, our team works closely with clients’ estate planning attorneys and their CPAs. The Backshore Wealth Management Group has over 95 Years of cumulative financial services experience. Briody and his team manage more than $489 million in assets (as of August 2024).

Paul recently completed two consecutive terms as a board member with Local Motion. In the winter season Paul volunteers with the Chill Foundation – a youth outreach program established by the Burton Snowboard Company. He can be found enjoying recreational cycling, spinning, salt water fishing, kayaking, winter sports and Paul is an active member of PSIA – Professional Ski Instructors of America and AASI – American Association of Snowboard Instructors.

In addition to holding the CERTIFIED FINANCIAL PLANNER® designation Paul has extensive knowledge developing comprehensive investment strategies for clients to include college savings and retirement income strategies.

Away From The Office

Paul and his wife Amy have travelled extensively internationally and hosted a youth exchange student from Finland in conjunction with the Rotary Program of South Burlington. In addition, their daughter Emma spent a year in Chile during an 11th grade exchange program and later taught in Spain upon graduation from CU-Boulder. Their son Justin recently completed a one-year international rotation in Amsterdam NL working for the Fintech startup Midaxo - both son and daughter now reside in Boston – close enough – but not too close.

1The Fundamental Choice program is not designed for excessively traded or inactive accounts and is not appropriate for all investors. Please carefully review the Wells Fargo Advisors advisory disclosure document for a full description of our services. The minimum account size for this program is $50,000.

2To achieve the CFP® designation Paul had to complete approved educational programs, pass rigorous examinations and meet stringent experience requirements. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

32021 Forbes Best-In-State Wealth Advisors: Awarded February 2021; Data compiled by SHOOK Research LLC based on the time period from 6/30/19-6/30/20 (Source: Forbes.com) The Forbes Best-In-State Wealth Advisors rating algorithm is based on the previous year’s industry experience, interviews, compliance records, assets under management, revenue and other criteria by SHOOK Research, LLC. Investment performance is not a criterion. Self-completed survey was used for rating. This rating is not related to the quality of the investment advice and based solely on the disclosed criteria.

4The Platinum Council (previously known as Premier Advisor) distinction is held by a select group of Financial Advisors within Wells Fargo Advisors and Wells Fargo Advisors Financial Network as measured by completion of educational components, business production based on the past year, and professionalism. Additional criteria, best practices and team structure, may also be used to determine recipients.

Wells Fargo Advisors Financial Network is not a legal or tax advisor.

Contact

Jennifer K. Navin

- Partner

Jennifer K. Navin

- Partner

1,560 Miles run a year

11 Years traveling to Hilton Head Island

1 Bucket list item, a trip to Italy

Focus

Jennifer has over twenty years of experience helping clients make informed investment decisions as well as delivering a comprehensive planning approach. Jennifer has a deep understanding of the financial markets and a commitment to helping her clients achieve their financial goals. She provides guidance in portfolio construction, risk management, budgeting, and retirement income strategies. Jennifer is a Certified Divorce Financial Analyst® and works with individuals regarding financial issues surrounding divorce.

Background And Experience

A Vermont native, Jennifer earned her Bachelor of Science in Business Administration from Saint Michael’s College in 1999, where she also played on the women’s soccer team. Jennifer began her financial services career in 2000, with First Albany Corporation a predecessor firm of Wells Fargo Advisors. She holds her Series 7, Series 63 and Series 65 Securities Registrations. She has over twenty years of experience supporting and managing client relationships. In 2020, she acquired her Certified Divorce Financial Analyst® designation.

Away From The Office

Jennifer and her husband live in South Burlington with their three children. Jennifer is an avid runner and enjoys skiing and golfing. She and her family visit Hilton Head Island every April to enjoy life in the low country. Jennifer is a former Greater Burlington Girls Soccer League youth soccer coach and continues to support youth soccer as well as the Leukemia and Lymphoma Society.

The use of the CDFA® designation does not permit Wells Fargo Advisors or its Financial Advisors to provide legal advice, nor is it meant to imply that the firm or its associates are acting as experts in this field.

Contact

Alex Wordsworth

- Managing Director

Alex Wordsworth

- Managing Director

25 years spent in the North Carolina high country and Atlantic Beach

5 years of coaching little league

3 children who attended Appalachian State University

Focus

What kind of financial advisor do you want sitting across the table from you? Alex Wordsworth joined Backshore Wealth Management Group to be on the same side of the table with his clients. Throughout his fifteen years in the financial services industry, Alex has a passion for helping his clients develop a plan and making that plan work for them. He wants to help his clients succeed long-term and give them the ability to enjoy their retirement years.

Background And Experience

By staying in lockstep with his clients, Alex believes he has the ability to put them at ease when markets get volatile. He is there for the entire journey to maintain the plan through the ups and downs. Alex believes in diligently working to be a positive influence in the lives of his clients and his community. Wells Fargo Advisors Financial Network has named Alex a Platinum Council Advisor in 2014, 2015, 2020, and 2021.

Away From The Office

Alex and wife Miri have been residents of Greenville, North Carolina for nearly twenty years. They are active in the Greenville Covenant Church, their local chapter of Building Hope and Pitt County Young Life. Alex stays active by hiking, playing golf & tennis, which is a big reason why he supports the JH Rose Athletic Foundation. He has a BS in Finance, Economics & Banking from Appalachian State University and received his Master’s in Business Administration from John Hopkins University. On the weekends, you will find him in the stands at his Alma Mater, cheering on the Mountaineers.

The Platinum Council (previously known as Premier Advisor) distinction is held by a select group of Financial Advisors within Wells Fargo Advisors Financial Network as measured by completion of educational components, business production based on the past year, and professionalism. Additional criteria, best practices and team structure may also be used to determine recipients.

Contact

Sheryl Davis

- Operations Manager

Sheryl Davis

- Operations Manager

50 houseplants

30 years boating on Lake Champlain

2 Grandchildren

Focus

As the Operations Manager, Sheryl plays a critical role in ensuring that the practice functions smoothly on a day-to-day basis. She works closely with clients in the management of their portfolios, new client onboarding and asset transfer as well as estate settlement. Sheryl is skilled in navigating the organizational and operational complexities that arise in the running of the practice. She leverages decades of experience combined with a passion and commitment to a high level of personal and attentive service to deliver an exceptional client experience.

Background And Experience

Originally from the Berkshires in Massachusetts, Sheryl grew up with a passion for animals always bringing the strays home. She earned an Associate degree as a Veterinary technician at Becker Junior College in Worcester MA. After moving to Vermont in 1991, Sheryl started her career in financial services with A.G. Edwards and Sons (a predecessor firm) as a receptionist and quickly found her place as a client associate. Sheryl holds the Series 7, Series 66, and Series 24 General Securities Principal securities registrations, insurance licenses, as well as the Certified Retirement Plan Specialist™ Designation from the College of Financial Planning.

Away From The Office

Sheryl and her husband Kevin live in Burlington Vermont with their 2 dogs, 2 cats and 2 birds. Sheryl and Kevin, through a blended family, raised 5 children and have 2 beautiful granddaughters. Sheryl enjoys Calligraphy, horticulture, boating on Lake Champlain, traveling and family time with her children and grandchildren.

Wells Fargo Advisors Financial Network Group is not a legal or tax advisor.

Contact

Amy Phippen

- Registered Client Services Associate

Amy Phippen

- Registered Client Services Associate

Has lived in Boston, NYC, and the mountains of Colorado

Takes cold water plunges – willingly!

Loves chocolate.

Focus

Amy Phippen has always been a listener. In her role as Registered Client Service Associate at Backshore Wealth Management, she maximizes the client experience by listening to their needs and wants before anything else. As creative as she is easy to work with, Amy also assists the team with daily functions in their mission to build and maintain meaningful relationships.

Background And Experience

Prior to joining the team at Backshore, Amy built a strong record in serving clients and streamlining operations at places like Epoch Investment Partners, Piper Sandler & Company, and the District Attorney’s Office of Summit County Colorado. Born in Connecticut with an adventurous spirit, she earned a Bachelors from the University of Vermont before heeding the call to live in unique and exciting places across the nation.

Away From The Office

Now residing back in Vermont, Amy enjoys gathering with friends & family to ski in the winter and relax by the pool in the summer. In addition to being a loving mother & wife, she dedicates her time to local chapters of the Humane Society.

Contact

Beryl Sorscher

- CFP

- CRPS

- Managing Director

- Senior PIM Portfolio Manager

Beryl Sorscher

- CFP

- CRPS

- Managing Director

- Senior PIM Portfolio Manager

For over 25 years, through vastly different market conditions and cycles, I have counseled my clients and endeavored to grow their assets. For almost 20 of those years, I have held the prestigious CERTIFIED FINANCIAL PLANNER® certification.

My investment philosophy sets out to achieve returns conveniently and prudently using a conservative, well defined and disciplined methodology. My advice is personalized to each individual, and I create custom portfolios that reflect each of his or hers needs and comfort level. Whether the client is focused on building their wealth, transitioning to retirement or receiving monthly income, I strive to help them in the same convenient and responsible manner.

I make every effort to be personally available to clarify, demystify and explain the complexities of the financial world, offer meaningful advice, and to be sure we are consistently on the right track together.

My Experience

· 1995 - 2000 : Prudential Securities

· 2000 - 2009 : PaineWebber/UBS

· 2009 - 2024 : Wells Fargo Advisors

· 2024 – Present: Wells Fargo Advisors Financial Network

My Education & Credentials

· Masters of Science- Johns Hopkins University

· College for Financial Planning

· Senior PIM Portfolio Manager

My Areas of Focus

· Advisory Services

· Business Services

· Estate Planning Strategies

· IRAs & IRA Strategies

· Retirement Planning

Contact

Pace Sorscher

- First Vice President

Pace Sorscher

- First Vice President

With a background in emergency medicine, I have the opportunity to benefit society in dual roles. Blending the medical and financial fields enables me to uniquely understand and provide for the needs of the medical community as well as all other high net worth individuals.

My Education & Credentials

· Bachelor of Individualized Studies - Fairleigh Dickinson University

My Areas of Focus

· Estate Planning Strategies

· IRAs & IRA Strategies

· Retirement Planning

Contact

Fred Hadlow

- Partner

Fred Hadlow

- Partner

well-being of accomplished individuals, families and businesses.

Prior to becoming a Partner of Upper Valley Wealth Management, Fred was a Senior Vice President, Investment Officer at Wells Fargo Advisors locations in both Keene and Brattleboro since 2012.

Before entering wealth management, Fred held leadership positions at multiple Fortune 500

companies, including Stanley/Black & Decker and the Timken Company.

Fred and his team can assist clients with all aspects of financial needs ranging from saving for

retirement and college expenses, insurance solutions, sophisticated investment planning, and

estate planning strategies. Wells Fargo Advisors Financial Network is not a legal or tax advisor.

Fred is a graduate of Trinity College, Hartford, CT with a B.S. in Economics. He earned his

M.B.A at Thunderbird, Graduate School of International Management.

Investment products and services are offered through Wells Fargo Advisors Financial Network, LLC (WFAFN), Member SIPC. Upper Valley Wealth Management is a separate entity from WFAFN.

Contact

Christine Hadlow

- Client Associate

Christine Hadlow

- Client Associate

She received a Master of International Management (MIM) from the Thunderbird School of Global Management in Phoenix, AZ.

Prior to joining UVWM, Christine was the Member Services Manager at the Greater Keene & Peterborough Chamber of Commerce (now Monadnock Collaborative) responsible for membership and marketing. Before that she had a career in International Marketing and Product Management at the L’Oreal Groupe.

Christine lives in Westmoreland, NH with her husband Fred. When not cheering on the Penn State Nittany Lions, she enjoys practicing yoga, reading, cooking and spending time in nature.

Contact

Important notice: You are leaving the Wells Fargo website

PLEASE NOTE: By clicking on this link, you will leave the Wells Fargo Advisors Web site and enter a privately owned web site created, operated and maintained by a third-party, which is not affiliated with Wells Fargo Advisors or its companies. The information and opinions found on this website have not been verified by our Firm, nor do we make any representations as to its accuracy and completeness. By linking to this Web site, Wells Fargo Advisors is not endorsing this third-party’s products and services, or its privacy and security policies, which may differ from Wells Fargo Advisors. We recommend that you review this third-party’s policies and terms and conditions to fully understand what information may be collected and maintained as a result of your visit to this website.