Each client is unique. Our DNA® System focuses on you.

Your Financial DNA consists of all of your unique life and financial characteristics, including your risk profile, time horizon, personal and financial priorities, business interests, philanthropic intensions and more. Brusca & George Private Wealth Consulting Group has been working with affluent professionals and families for many years. We have developed a process for organizing complex financial matters into simple terms.

We have developed a process for organizing complex financial matters into simple terms.

Trust services available through banking and trust affiliates in addition to non-affiliated companies of Wells Fargo Advisors. Wells Fargo Advisors and its affiliates do not provide legal or tax advice. Any estate plan should be reviewed by an attorney who specializes in estate planning and is licensed to practice law in your state.

Wells Fargo Advisors is not a legal or tax advisor. However, we will be glad to work with you , your accountant, tax advisor and or lawyer to help you meet your financial goals.

A More Comprehensive Approach

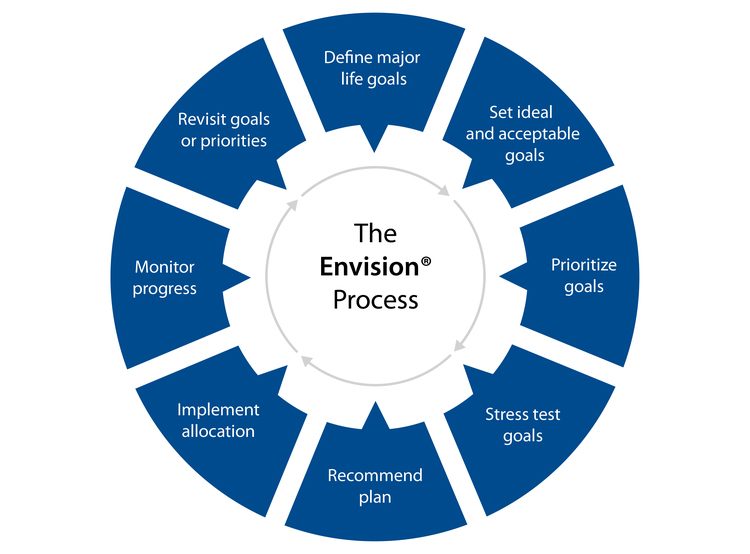

Process & Methodology

IMPORTANT: The projections or other information generated by the Envision process regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary with each use and over time.

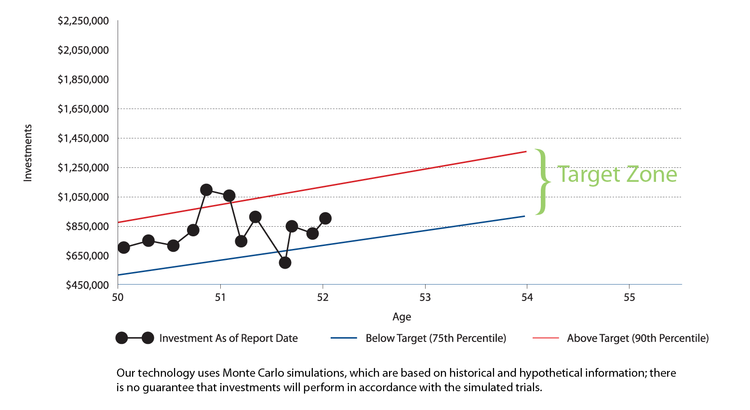

Track Your Progress

Once we implement your plan, We'll meet to review it on a timely basis to make sure you are still on track to meet your goals.

• Envision® methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2003-2021 Wealthcare Capital Management LLC. All Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.