Our Envision planning process is designed to help bring clarity to your financial life. It helps you align your financial life with your real life. We use the Envision process as a life planning tool to help you:

-

Explore your life goals

-

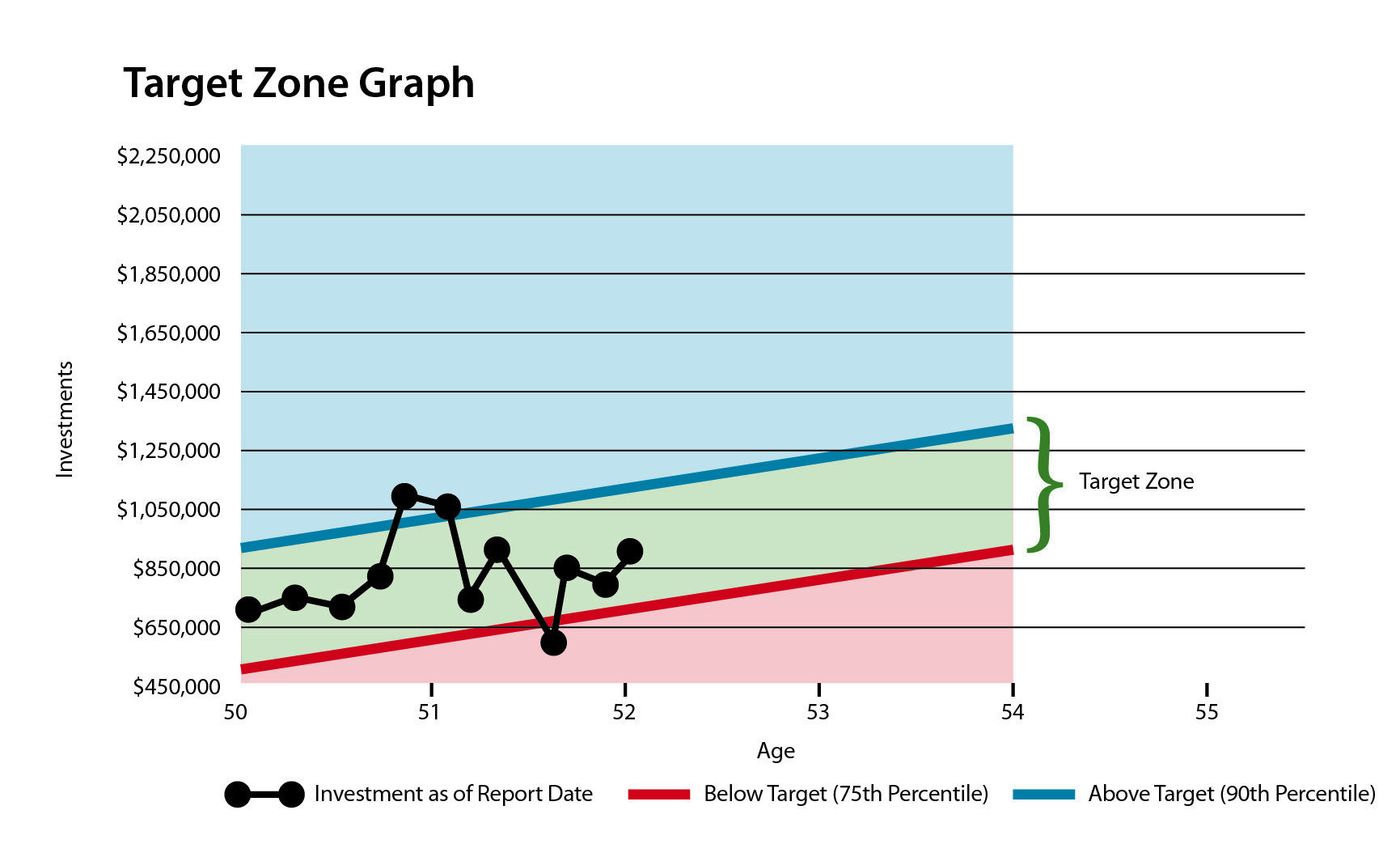

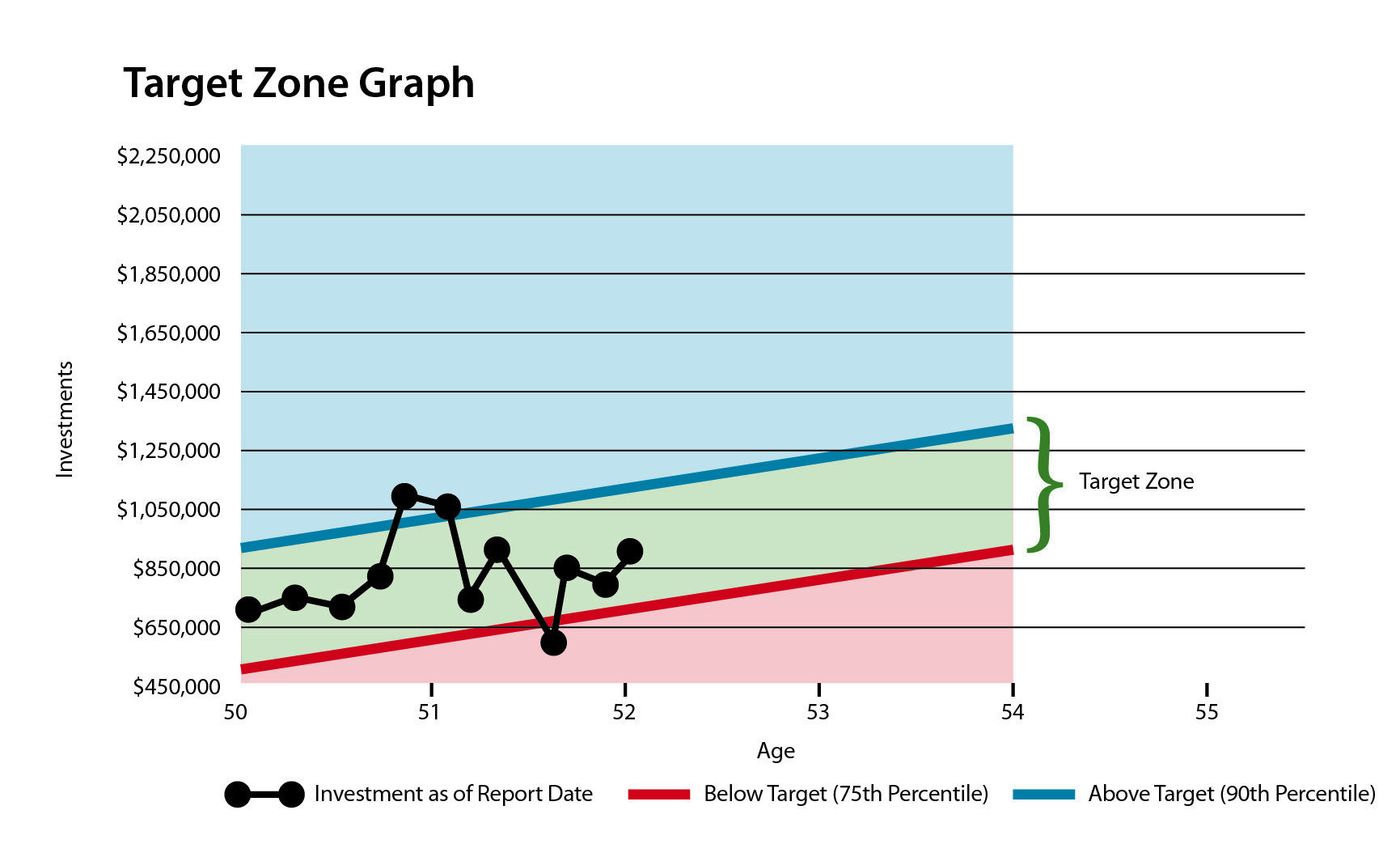

Plan your investments around benchmarks that hold real meaning for you

-

Track your progress toward them

Step 1. Getting to know you

During our initial meeting, we listen as you explain about your goals, needs, dreams and challenges. Through our conversation, we uncover the details of your financial life and carefully consider if we are a good fit to work together. We discuss your long-term and short-term goals, priorities, and the investment strategies you already have in place. We share information about our team and answer any of your questions.

Step 2. Analyzing your financial picture

Insurance products are offered through nonbank insurance agency affiliates of Wells Fargo & Company and are underwritten by unaffiliated insurance companies.

Step 3. Recommending your customized plan

Step 4. Reviewing your progress

Our Envision planning process puts your financial picture in focus.

IMPORTANT: The projections or other information generated by Envision regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time. Envision methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. ©2003-2020 Wealthcare Capital Management LLC. All Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.