What are your most important investment goals?

The Envision® process offers you an effective way to identify your highest-priority goals and develop an investment plan designed to provide you with the wealth you need to live your life the way you want. Instead of tracking your portfolio’s performance against a standardized index, such as the S&P 500, so you can monitor progress toward achieving your life goals on your own fully customized index. It includes:

If your life goals change with time or if fluctuating market conditions alter your plan's results, the Envision process offers the flexibility to make adjustments as necessary.

Research shows that among surveyed Envision plan holders:

98%

agree their plan is personally tailored to meet their unique financial goals

96%

agree having an Envision plan helps them feel better prepared for retirement

92%

agree their plan helps them talk to their Financial Advisor about significant life events

Source: Results are based on a survey conducted online by Versta Research from June 5 – June 22, 2019 among 457 Envision clients with Financial Advisor relationships. Results are not representative of other client experiences or indicative of future success or performance. The Envision progress is a brokerage service provided by Wells Fargo Advisors.

Putting your plan in motion

We will “stress test” your investment portfolio through statistical modeling when creating your plan to help you determine how likely you are to achieve your goals.

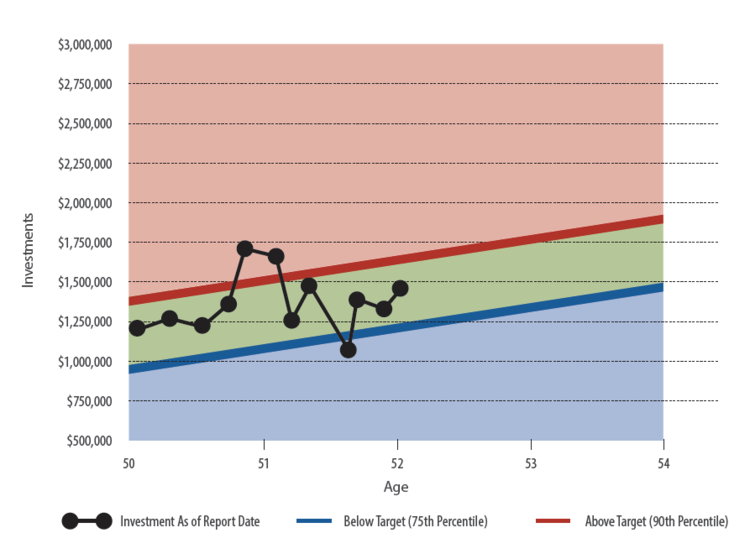

One output from the test will be a plan result – a number between 0 and 100 that estimates the probability of your plan's success. A “reasonable” plan result of 75 to 90 is your investment sweet spot. We call this the “Target Zone.”

Anything above the Target Zone may show overconfidence in reaching some of your high-priority goals. If your plan result is higher than 90, you might assume more risk than necessary or sacrifice certain goals at the expense of others.

On the other end, you don’t want a plan result lower than a 75. Anything below the Target Zone may show less confidence in your ability to achieve your goals.

Envision® methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2003-2021 Wealthcare Capital Management LLC. All Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.